Survey: Most regional investors want a better due diligence process

April 7, 2017 | Meghan LeVota

For investors, investigating deals isn’t always an easy process.

From examining an industry’s opportunity to loads of legal analysis, the amount of work in the due diligence process is often enough to deter financiers from investing in a firm.

That’s why in a recent survey, a majority of regional investors said they’d love a better way to conduct due diligence. Conducted by KCSourceLink and the Alternative Investment Forum, the survey found that almost two-thirds of regional investors say it would be helpful to have a standardized due diligence process for venture offerings.

“In the spring of 2016 we did a survey with KCSourceLink to find out why some investors were reluctant to invest in early stage entrepreneurial deals,” said AIF co-founder Mark Meyerdirk. “One of the major findings of that survey was that new investors don’t know how to properly investigate deals. Based on this finding we decided to do a follow-up survey at the end of 2016 of professional investors, who do this for a living, to see if there was a standardized due diligence process.”

The organizations asked 41 regional funds and investors — such as KCRise fund, Fulcrum Global Capital and Brown Cow Capital — about what the due diligence process looks like for them. Often, the biggest expense is time, the survey revealed.

The study showed that 85 percent of investors spend more than 20 hours conducting due diligence per venture opportunity considered. 36 percent spend more than 60 hours on each potential deal.

Most commonly, investors vet the target company by asking the management team for data, reviewing legal and financial details, analyzing the intellectual property and reviewing industry competition.

“Insights into what investors look for helps us educate both investors and entrepreneurs to create a better process for accessing capital in Kansas City,” KCSourceLink founder Maria Meyers said in a release.

The survey concluded that many regional investors may be interested in outsourcing due diligence work.

That’s why AIF and KCSourceLink are teaming up to create a Venture Stage Due Diligence Report Template, based on that recent data the survey secured. In addition, Meyerdirk said he will approach the Ewing Marion Kauffman Foundation with the possibility of conducting a similar survey on a national scale.

To read the full report, click here.

2017 Startups to Watch

stats here

Related Posts on Startland News

WeCode KC founder earns women’s achievement honor; adds national STEM figure to her org’s leadership

Only a few days into March, 2023 is already proving to be a big year for WeCode KC, noted co-founder and CEO Tammy Buckner. The organization — which operates with a mission is to give youth, especially those in the urban core, the opportunity to learn technology concepts and leadership skills and create a pipeline…

‘Shark Tank’ sets stage for Bryght Labs’ new smart play product rollout amid MO funding uptick

Fresh off a successful appearance on “Shark Tank,” Olathe-based connected gaming startup Bryght Labs hopes to capitalize on that exposure to build momentum, said founder and CEO Jeff Wigh. Wigh and co-founder Adam Roush were featured on an episode that aired in December, pitching their product ChessUp, a patented chess board that uses AI technology…

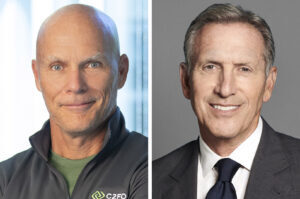

C2FO: $10M investment from Starbucks CEO will unlock $100M in loans to small, diverse businesses

One of Kansas City’s most successful scaling startups announced Tuesday a new initiative — funded by Sheri Schultz and Starbucks CEO Howard Schultz — to provide access to $100 million in working capital for small and diverse businesses. The partnership — designed to use Leawood-based C2FO’s innovative lending approach to deliver flexible, equitable access to…

Small town KS just blocked its new crypto mining neighbor: Why this could be just the start of a rural-tech clash

Editor’s note: This story was originally published by Kansas City PBS/Flatland, a member of the KC Media Collective, which also includes Startland News, KCUR 89.3, American Public Square, The Kansas City Beacon, and Missouri Business Alert. Click here to read the original story. MCLOUTH, Kansas — Parked cars lined Lucy Street in the center of a normally quiet…