Survey: Most regional investors want a better due diligence process

April 7, 2017 | Meghan LeVota

For investors, investigating deals isn’t always an easy process.

From examining an industry’s opportunity to loads of legal analysis, the amount of work in the due diligence process is often enough to deter financiers from investing in a firm.

That’s why in a recent survey, a majority of regional investors said they’d love a better way to conduct due diligence. Conducted by KCSourceLink and the Alternative Investment Forum, the survey found that almost two-thirds of regional investors say it would be helpful to have a standardized due diligence process for venture offerings.

“In the spring of 2016 we did a survey with KCSourceLink to find out why some investors were reluctant to invest in early stage entrepreneurial deals,” said AIF co-founder Mark Meyerdirk. “One of the major findings of that survey was that new investors don’t know how to properly investigate deals. Based on this finding we decided to do a follow-up survey at the end of 2016 of professional investors, who do this for a living, to see if there was a standardized due diligence process.”

The organizations asked 41 regional funds and investors — such as KCRise fund, Fulcrum Global Capital and Brown Cow Capital — about what the due diligence process looks like for them. Often, the biggest expense is time, the survey revealed.

The study showed that 85 percent of investors spend more than 20 hours conducting due diligence per venture opportunity considered. 36 percent spend more than 60 hours on each potential deal.

Most commonly, investors vet the target company by asking the management team for data, reviewing legal and financial details, analyzing the intellectual property and reviewing industry competition.

“Insights into what investors look for helps us educate both investors and entrepreneurs to create a better process for accessing capital in Kansas City,” KCSourceLink founder Maria Meyers said in a release.

The survey concluded that many regional investors may be interested in outsourcing due diligence work.

That’s why AIF and KCSourceLink are teaming up to create a Venture Stage Due Diligence Report Template, based on that recent data the survey secured. In addition, Meyerdirk said he will approach the Ewing Marion Kauffman Foundation with the possibility of conducting a similar survey on a national scale.

To read the full report, click here.

2017 Startups to Watch

stats here

Related Posts on Startland News

K-State awarded $500K state grant to boost border-to-border innovation, entrepreneurship

Startland News’ Startup Road Trip series explores innovative and uncommon ideas finding success in rural America and Midwestern startup hubs outside the Kansas City metro. MANHATTAN, Kansas — A newly launched grant program is expected to help Kansas’ six state universities accelerate innovation activities within the world of higher education. At Kansas State University, a…

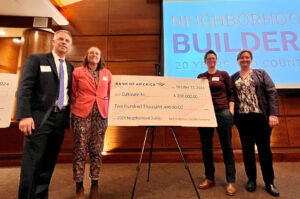

These KC nonprofits showed resiliency; their reward: $200K grants from Bank of America

Bank of America this fall continued the 20-year run for its Neighborhood Builder grants program, awarding two Kansas City nonprofits with $200,000 grants and access to exclusive leadership training resources and a national network of nonprofit peers. The 2024 honorees are Kansas City Girls Preparatory Academy and Cultivate Kansas City — tapped for their work…

This entrepreneur jams Special Olympics advocacy (and a little chicory) into his Missouri storefront

Editor’s note: The following story was produced through a paid partnership with MOSourceLink, which boasts a mission to help entrepreneurs and small businesses across the state of Missouri grow and succeed by providing free, easy access to the help they need — when they need it. EDINA, Missouri — Jared Niemeyer started making homemade jam to…

How a crowdfunding site is adding extra cheddar to Buffalo State Pizza’s relocation plans

Confidence is already in the box for Buffalo State Pizza Co.’s owners as they look to everyday investors to help their business complete and grow into a new space near downtown Overland Park, they said. The duo — Philippe Lechevin and Steve Robson — launched a campaign this fall on the crowdfunding site Honeycomb Credit…