Five Elms Capital leads investment round in Atlanta SaaS firm

February 13, 2017 | Bobby Burch

Five Elms Capital is continuing a streak of deals to kick off 2017.

The Kansas City-based venture capital firm announced Monday that it’s the lead investor in MemberClicks, a SaaS provider that helps associations, trade groups and nonprofits manage members. Five Elms — which was joined by New York-based Level Equity as lead investors — did not disclose the value of its investment in the Atlanta-based company.

The investment comes about a month after Five Elms investment in a San Diego-based security firm.

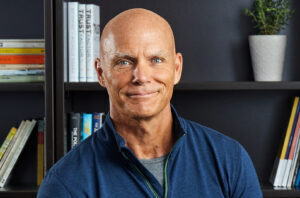

Five Elms managing partner Fred Coulson said that his company has been proactive in targeting the association management space.

“They have been very thoughtful about building a disruptive and modern SaaS platform in a space where many others have invested far too little in their technology stacks,” Coulson said in a release. “This investment comes at a time when MemberClicks has all the pieces in place to step on the gas and meaningfully scale their business.”

MemberClicks CEO Mark Sedgley said that the capital will allow the company to enhance its product offering and expand its sales and marketing efforts. MemberClicks works with more than 1,600 North American organizations, the company said.

Five Elms has invested in other area firms such as Kansas City-based United Medicare Advisors, Lenexa-based Smart Warehousing and Kansas City-based Spring Venture Group, of which Coulson is founder and chairman. Five Elms focuses on investments of $3 to $30 million in business-to-business firms with $2 to $20 million in revenue.

2017 Startups to Watch

stats here

Related Posts on Startland News

C2FO hits its first billion-dollar day; marks $400B in funding to customers as global finance shifts

A record-breaking year for C2FO serves as a proof point itself, said Sandy Kemper, revealing the Kansas City-built fintech surpassed $400 billion in lifetime funding to its customers in 2024 and achieved $1 billion of daily funding for the first time. “The success of the past year only demonstrates the tremendous need for more efficient…

KC Biohub leader bullish on Tech Hubs funding after region missing from latest grants list

Kansas City is still in the running for a chunk of the remaining $280 million in expected funding for federal Tech Hubs implementation grants, said Melissa Roberts Chapman, emphasizing the region remains primed and competitive in the process despite the KC BioHub not being among the latest awardees announced by the program. Six other projects…

KCMO secures $11.8M to expand city’s EV charging infrastructure, targeting underinvested neighborhoods

A freshly charged tranche of funding is expected to help power Kansas City’s efforts to install 256 new electric vehicle charging points across urban and suburban areas of the city, Mayor Quinton Lucas announced Tuesday. “This project will help cement Kansas City’s commitment to sustainable transportation and access to electric vehicle resources,” Lucas said. “A…

Houston-based fund leads effort to restore KC’s iconic Garment House with $3.2M already invested

A strategic investment in Kansas City history is expected to bring new purpose to a downtown building known locally as The Garment House — creating what developers envision as an eclectic, but contemporary experience. Revitalization Unlimited — a fund dedicated to preserving historically significant U.S. real estate and legacy industrial businesses in local communities —…