Tech firm LendingStandard raises $600K, lands big client

January 5, 2017 | Meghan LeVota

Kansas City-based tech firm LendingStandard announced Thursday that it’s closed on an angel capital round of $600,000.

CEO Andy Kallenbach said he’s pleased with the direction of the startup, which created software for multi-family lender organizations. Kallenbach added that he’s excited by what opportunities the financing affords LendingStandard.

“This investment will allow us to develop new targeted multifamily product solutions that will differentiate LendingStandard in the marketplace,” Kallenbach said. “Our early 2017 plans now include an additional, more substantial, investment round that will allow us to scale the business, add valuable team resources and to serve as the catalyst for new client and revenue growth.”

LendingStandard is a software-as-a-service platform on which multi-family lender organizations can receive and collaborate on documentation required to finance a commercial loan transaction. The platform helps cut about two months of work off the lending process thanks to collaborative tools and checklists that reduce errors and result in less expensive legal fees.

In other words, LendingStandard is reducing paperwork for an industry that has been stuck in the 80s. Kallenbach said that the paperwork often creates a struggle for multi-family lenders to complete, and frequently spurs additional problems.

“You may think that ‘it’s just a checklist, why can’t people just follow it?’ [about the paperwork,]” Kallenbach mused. “But, the problem is that everything is just so tedious, we’re talking over 100 different exhibits necessary for just one loan. “

Lending Standard in 2016 snagged Berkadia — the largest multi-family lender company in the United States — as a client.

“They are the 500-pound gorilla,” Kallenbach said. “I’m grateful to be working with the titan of the industry.”

After being located in downtown Kansas City for a year, LendingStandard moved to the Heartland House in Kansas City Startup Village last year. Kallenbach said the new location has made him feel at home in the community, adding that he loves what he does.

“I love being able to provide solutions to people doing tedious work and trying to make their job easier,” Kallenbach said. “I think a lot of satisfaction in our business has been able to help lenders do their job better.

In 2015, LendingStandard raised nearly $500,000. The startup also took part in the University of Missouri-Kansas City’s E-Scholars program and is a graduate of SparkLabKC.

2017 Startups to Watch

stats here

Related Posts on Startland News

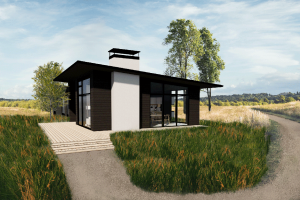

Porch Light Plans hopes to bring durable, affordable home design to the masses

Modern homes should be durable and well-designed enough to last hundreds of years, said Katie Hoke. Lawrence-based Porch Light Plans combines sleek aesthetics with thicker insulation and fewer windows to achieve a contemporary housing option with the potential to slash utility bills in half, said Hoke co-founder of the boutique architectural design firm. “If every…

WYCO sunglasses customizes KC cool for a brightly-colored nationwide vision

Kasey Skala frames WYCO as a Kansas City brand ready to look beyond county or state boundaries, he said. “I think it’s great that we started here in the Midwest. We’re proud of being a Midwest brand, growing it here and taking [advantage of] what Kansas City has to offer,” said Skala, WYCO chief marketing…

Now in new Crossroads space, Rightfully Sewn prepares to welcome male sewists (Photos)

The secret to any startup venture is to move forward one stitch at a time, said Rightfully Sewn founder Jennifer Lapka. “Start small, struggle, have success, then scale,” she said, quoting one of her many mentors. Freshly moved into a 2,200-square-foot atelier, or design studio, at 1800 Wyandotte St. in the Crossroads, Rightfully Sewn is…

CommunityAmerica teen-led innovation effort lauded for developing college cost calculator

College degrees come with two price tags: the sticker price and the net price. A new free tool from the CommunityAmerica teen advisory board is being celebrated for helping students solve the complicated equation that separates the two — as well as determine which college options are financially realistic. “[With] some of the more elite schools,…