Tech firm LendingStandard raises $600K, lands big client

January 5, 2017 | Meghan LeVota

Kansas City-based tech firm LendingStandard announced Thursday that it’s closed on an angel capital round of $600,000.

CEO Andy Kallenbach said he’s pleased with the direction of the startup, which created software for multi-family lender organizations. Kallenbach added that he’s excited by what opportunities the financing affords LendingStandard.

“This investment will allow us to develop new targeted multifamily product solutions that will differentiate LendingStandard in the marketplace,” Kallenbach said. “Our early 2017 plans now include an additional, more substantial, investment round that will allow us to scale the business, add valuable team resources and to serve as the catalyst for new client and revenue growth.”

LendingStandard is a software-as-a-service platform on which multi-family lender organizations can receive and collaborate on documentation required to finance a commercial loan transaction. The platform helps cut about two months of work off the lending process thanks to collaborative tools and checklists that reduce errors and result in less expensive legal fees.

In other words, LendingStandard is reducing paperwork for an industry that has been stuck in the 80s. Kallenbach said that the paperwork often creates a struggle for multi-family lenders to complete, and frequently spurs additional problems.

“You may think that ‘it’s just a checklist, why can’t people just follow it?’ [about the paperwork,]” Kallenbach mused. “But, the problem is that everything is just so tedious, we’re talking over 100 different exhibits necessary for just one loan. “

Lending Standard in 2016 snagged Berkadia — the largest multi-family lender company in the United States — as a client.

“They are the 500-pound gorilla,” Kallenbach said. “I’m grateful to be working with the titan of the industry.”

After being located in downtown Kansas City for a year, LendingStandard moved to the Heartland House in Kansas City Startup Village last year. Kallenbach said the new location has made him feel at home in the community, adding that he loves what he does.

“I love being able to provide solutions to people doing tedious work and trying to make their job easier,” Kallenbach said. “I think a lot of satisfaction in our business has been able to help lenders do their job better.

In 2015, LendingStandard raised nearly $500,000. The startup also took part in the University of Missouri-Kansas City’s E-Scholars program and is a graduate of SparkLabKC.

2017 Startups to Watch

stats here

Related Posts on Startland News

Calendar update: Startup Weekend KC event postponed until fall, organizer says

Entrepreneurs hungering for intensive, organic product development will have to wait a few more months for their fix. Techstars Startup Weekend KC — originally slated for April 26-28 at the SafetyCulture North American Headquarters in the Crossroads — has been postponed until September, event organizer Rebecca Dove said. The annual “three-day long sprint to launch…

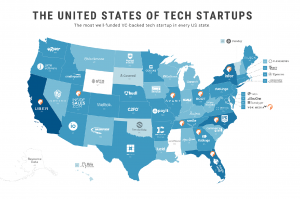

Most-funded tech startups: $100M-plus investment puts PayIt on the map with C2FO

Companies in the Midwest and South are making major plays for investment dollars, according to CB Insights, with Kansas City’s PayIt and C2FO earning spots on the latest map of the nation’s most well-funded tech startups. “The tech boom has diffused beyond the traditional hotbeds of California, New York, and Massachusetts, across the entire United…

Prime Digital Academy pledges $20K in scholarships to boost inclusion in KC tech

A coding boot camp that freshly arrived in Kansas City this winter plans to underwrite $20,000 in scholarships specifically for individuals who are part of demographics underrepresented in the coding profession, said Rachael Bromander. “At a time in the market where tech talent is scarce and growth is booming, programs like Prime represent a way…