Firebrand Ventures joins $6.85M round in Des Moines startup

January 20, 2017 | Bobby Burch

Continuing a streak of investments, Kansas City-based Firebrand Ventures joined a sizable investment in an Iowa-based payments processing startup.

Firebrand joined six other venture funds in a $6.85 million funding round in Des Moines-based Dwolla, which builds applications that facilitate bank transfers, manages customers and verifies bank accounts. The round was led by Union Square Ventures and Foundry Group with participation by Next Level Ventures, Ludlow Ventures, High Alpha, Firebrand and Detroit Venture Partners.

The company said the funds will be used to hire and expand sales operations at its headquarters in Des Moines.

“The Midwest has a wealth of resources, but its biggest strength is its people and that’s a competitive advantage we plan on continuing to invest in,” Dwolla CEO and founder Ben Milne said in a release.

Founded in 2010, Dwolla has raised more than $40 million to date and serves hundreds of clients from startups to the U.S. federal government. The company is now focusing on its Access API, which makes it easy for businesses and developers to integrate the banking system into their software.

Firebrand Ventures managing director John Fein said that he’s known Ben Milne for years, and has been impressed by the firm’s team.

“I’ve always thought they were great for several reasons,” Fein said. “The wonderful audacity to build their own payment network; their culture of building amazing things; staying focused despite the highs and lows of startup life; being obsessed with solving a huge and pervasive problem; and doing all of this from a Des Moines headquarters. … Firebrand has a team-first investment approach so this was perfect for us.”

Firebrand joins an impressive cast of investors in the round, most notably Union Square Ventures and the Foundry Group. Managing about $1 billion in assets across six funds, New York City-based Union Square was founded by Fred Wilson, a prolific and popular blogger on investing and early-stage business.

The Boulder-based Foundry Group’s leadership includes Brad Feld, a co-founder of Techstars, author of Startup Communities and supporter of the Kansas City Startup Village.

A relatively new fund, Firebrand’s Fein said he’s thrilled to invest alongside such esteemed venture groups.

“As with the teams with invest in, we also want to co-invest alongside exceptional people,” Fein said. “It’s fantastic to participate alongside Foundry Group, Union Square Ventures as well as the others. There’s an amazing group in this round. With Brad Feld and his team at Foundry, and Fred Wilson and his team at USV, it’s not just that they’re top tier funds with an incredible track record — they’re terrific people, too. Plus Brad has been an incredible mentor for me over the years so co-investing with Foundry makes it extra special. The awesome team at Dwolla is doing the hard work and with these investors behind them only good things will happen!”

Jordan Lampe, who leads Dwolla communications and policy affairs, said he’s excited to see the firm grow in the Midwest and with the help of regional investors.

“We’re excited to welcome Firebrand to the Dwolla family, along with an all-star cast of Midwest investors,” Lampe said. “Dwolla was founded in the Midwest and is now funded by the Midwest. That affords us a kind of mentality that plays really well to the type of business we’re now focused on: helping others build great companies.”

Related Posts on Startland News

KC investors power $4.5M round for OP startup poised to ‘unlock billions’ for its customers

Overland Park-based Realto has closed a $4.5 million funding round — thanks in large part to the backing of Kansas City-based investors. “We’re excited to welcome these important investors as we continue to expand our robust trading capabilities across the universe of alternative products,” Brian King, co-founder and CEO, said in announcement of the funding round which…

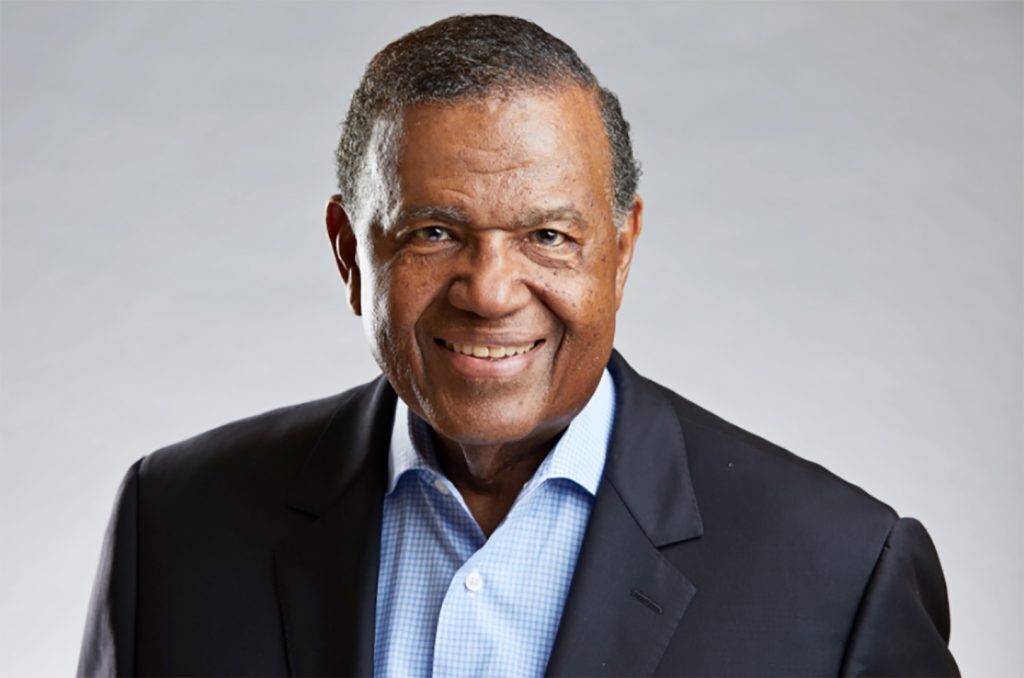

Firebrand Ventures closes $40M seed fund for ‘authentic’ founders in emerging communities; adds Leo Morton as advisor

A year after two prominent venture capital firms announced their merger, the consolidated Firebrand Ventures II is officially closed — reaching its $40 million target and having already invested in startups from Detroit, Seattle and Toronto. “Several years ago we raised our first funds — Boulder-based Blue Note Ventures and Kansas City-based Firebrand Ventures I —…

‘Nerds’ need value: Midwest trio connects global fintech players through virtual summit

Fintech workers and industry innovators are starving for human connection amid a crazy 10 months of COVID and a pandemic’s-worth of dull virtual events, said Zach Anderson Pettet. “All of us nerds in our specific space — being financial services and financial technology — haven’t been able to congregate, so there’s been a lot of…

$40M Firebrand II fund strengthened by Kansas City VC’s merger with Boulder firm, leaders say

Merging two venture capital funds focused on one startup-rich portfolio is expected to create a larger platform for founders in up-and-coming markets, said Chris Marks. “While a merger is unique in the venture world, this feels very natural based on our overlap in values, our shared commitment to supporting authentic leaders, and our similar focus…