Report: Area Latino business ownership surged in 2015

November 21, 2016 | Meghan LeVota

Latino business ownership is on the rise in the Kansas City area, according to a recent study.

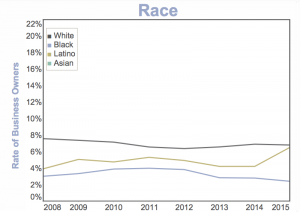

While area entrepreneurial activity has largely remained steady, the percent of Latinos that own businesses in Kansas City considerably increased from 2014 to 2015, according to the Ewing Marion Kauffman Foundation’s Index of Main Street Entrepreneurship.

Now just a hair away from the percent of white business owners per capita, Latino business ownership in Kansas City grew by about 40 percent, according to the report. In comparison, the rate of business ownership amongst whites in Kansas City stayed the same while entrepreneurship amongst African-Americans dropped about 15 percent.

Produced annually, the Kauffman Index of Main Street Entrepreneurship is a comprehensive report of small business activity in the United States. The index captures business activity in all industries and is based on both a nationally representative sample size of roughly 900,000 responses and a dataset covering approximately five million businesses.

Carlos Gomez, president of the Hispanic Chamber of Commerce of Greater Kansas City, said he’s not surprised by the Latino business metrics. In the last year, his organization has helped over 70 businesses get started.

In addition to connecting members of the community by providing resources and education, the Hispanic Chamber offers free help with the paperwork that early-stage firms often find difficult.

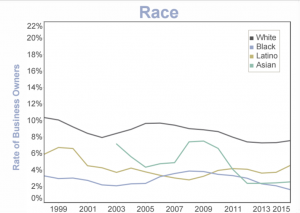

Gomez said that the increase in area Latino business ownership is thanks to an increase in the overall Latino population. The Latino population in Missouri increased about 80 percent from 2000 to 2010, according to the 2010 Census report — from about 118,600 to 212,500. In Kansas, the Latino population grew nearly 60 percent during the same time period — from 188,300 to 300,000.

Gomez added that many area Latinos are also immigrants, and that they’re often more likely to start businesses as a result.

“Immigrants bring in an entrepreneurial spirit that sometimes we (the native born) can take for granted,” Gomez said. “It’s hard for immigrants to take that risk and make that move (to America) — and that shows in their business.”

Gomez attributes the growth not just to immigrant culture — but Hispanic culture in particular. He said that for Hispanics, family and business are values that go together.

“As a second-generation Hispanic who was born here, I personally did not fight that challenge of coming to this country,” Gomez said. “But, I respect my grandparents for doing that for a better life for their kids. I remember their struggle and because of that, we as a community don’t want to take for granted the opportunity that is in front of us.”

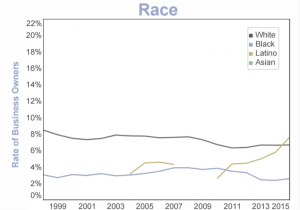

In Missouri, the percent of Latinos owning a business surpassed the rate of whites in 2016. While white business ownership maintained a steady 6.75 percent, the percent of Latinos owning a business reached a rate of 7.5 percent in 2015. In other words, out of every 1,000 Latinos in Missouri, about 75 own a business.

Kansas also experienced an uptick in Latino business ownership. The percent of Latino business owners grew from about 3.9 percent in 2014 to about 4.4 percent in 2015 — a roughly 13 percent increase.

Despite the area Latino business community expressing concerns over the U.S. Presidential election, Gomez remains optimistic in his community’s ability to thrive.

“There’s no other country where you can come in with nothing and yet the sky’s the limit,” Gomez said. “It’s up to you, and hard work does pay off. I’m proud that this country puts emphasis on that and encourages working hard.”

For more on the report click here.

Featured Business

2016 Startups to Watch

stats here

Related Posts on Startland News

GXPI-led $3.25M deal pushes Kansas City IoT firm Pepper over $15M investment mark

Pepper topped $15 million in investments this week — adding to its ownership structure through a sizeable deal led by GXPI, the investment arm of Evergy. “This strategic investment by Evergy gives us a great partner in the retail electric utility industry where IoT is beginning to play a critical role,” said Scott Ford, CEO…

Nearly $5M remains in Kansas angel tax credits as Aug 31 deadline looms; startups urged to apply

The clock is ticking for Kansas angel tax credits to be awarded to growing startups in 2018, said Rachèll Rowand. “We are looking for innovative businesses in Kansas that are under five years old,” said Rowand, program manager for the Kansas Department of Commerce, which administers the state’s angel tax program. “The biotechnology industry is…

Startland list reflects big wins across KC — but don’t get comfortable, warns founder

Kansas City has traction, said Davyeon Ross, but the city and its support network must keep the ball moving. “It’s impressive how much these startups and companies are contributing to the community and the economy,” said Ross co-founder and COO of ShotTracker, reacting to data within Startland’s 2018 list of Top Venture Capital-Backed Companies in…