Mid-America Angels set for second consecutive record-breaking year

July 18, 2016 | Bobby Burch

The Mid-America Angels is poised to make 2016 a record-breaking year.

The area investment group already has deployed $1.7 million via seven deals in the first six months of 2016, setting pace for its biggest year of investment in its ten-year history. In 2015, the firm set a record for its amount of capital deployed, dishing out $2.8 million via 9 investments.

In total, MAA has provided more than $20 million in capital to early-stage firms since 2006.

“Over the past ten years, we have been proud to support the growth of Kansas City’s early-stage companies through the deployment of private capital,” MAA managing director Rick Vaughn said in a release. “This year, we are on pace to support the growth of more Kansas City companies than ever before, and perhaps most importantly, our membership is growing as more investors begin to recognize the potential of early-stage investment as an asset class.”

In 2016, MAA invested in JobShakers, an employee referral software application and Tomboy Exchange, an apparel company. Other deals in 2016 provided follow-on capital to MAA’s existing portfolio companies, including Elias Animal Health, TVAX Biomedical, Nitride Solutions, Metactive Medical and Hilary’s Eat Well.

Seattle-based Tomboy Exchange is a new portfolio firm for MAA. It joined in a round led by the Women’s Capital Connection, which invested $115,000 in the company. Tomboy sells women’s underwear, clothing, jewelry and bags.

2016 Startups to Watch

stats here

Related Posts on Startland News

(Video) ESHIP Summit attendees ask: Can entrepreneurial support efforts actually be sustainable?

When more than 600 attendees gathered this week in Kansas City for the second ESHIP Summit, they each came with their own ecosystems, businesses, local governments and support networks in mind. They also brought questions. “What are they doing in their cities? What’s worked and what hasn’t worked? What can we adopt back at home…

Four key moments led to SoftVu’s exit (three missteps kept it from happening sooner)

Deals like the acquisition of KC-based SoftVu by an Alabama private equity firm don’t happen overnight. And founder Tim Donnelly gives near-equal weight to the trials and triumphs that led the marketing platform to its big exit. “We’ve done as much as we possibly can based on the mistakes we’ve made, the lessons that have…

Eyeing added impact, AltCap expands its KC service area

AltCap — a Kansas City-based community development financial institution that focuses on underserved populations — is expanding its footprint. In response to small businesses’ growing demand for capital, AltCap will now serve the entire Kansas City metro, including the Kansas counties of Wyandotte, Johnson, and Leavenworth. The move will allow AltCap to finance more small…

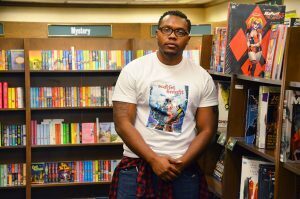

KC comic book creator Juaquan Herron refuses to wait on Hollywood any longer

Juaquan Herron has been to LA and back. The 32-year-old got tired of waiting. “I couch surfed, had a child who was not with me, but a supportive wife, and every day I was like, ‘What in the hell am I doing?’” said Herron, an actor and filmmaker who returned to Kansas City after being…