With $300M under management, Blooom is the fastest-growing robo advisor

June 2, 2016 | Bobby Burch

Area financial tech startup Blooom has another trophy for its chest of commendations.

The Leawood-based firm says its online tool to grow users’ 401(k)s has reached $300 million in assets under management in only 20 months. That swelling growth makes it the fastest-growing robo advisor ever — years faster than competitors in New York City and Silicon Valley, the company said.

A former Goldman Sachs banker, Blooom president Greg Smith said it’s a remarkable accomplishment.

“Blooom achieved this milestone in approximately half the time of other robo-advisors and while needing to raise less than one-fifth of the outside capital,” Smith said, citing monthly SEC filings.

In addition to 100 percent revenue growth in 2016, Smith said that Blooom has analyzed the health of more than $1 billion 401(k) balances. Blooom’s tool analyzes a user’s 401(k) and shows its health through a flower in various growth stages, then offers professional advice on how to allocate funds. To access Blooom’s services, users pay $5 per month for an account less than $20,000, $19 per month for accounts between $20,000 – $500,000 and $99 for accounts more than $500,000.

Blooom CEO Chris Costello said that the platform resonates well with younger people who lack knowledge about their 401(k)s and are more apt to conduct financial transactions online. 90 million Americans have a 401(k) or similar retirement account, but Costello said nearly 90 percent of those people are unaware of their investment strategies and don’t receive professional guidance.

Costello said that the company is scoring customers thanks to the simplicity of its platform to improve 401(k)s.

“Most of our growth has been organic, through word of mouth, because our clients,” Costello said in a release “Everyday, regular Americans in all 50 States see how meaningfully we can improve their 401k, cut their hidden fees and potentially add years in retirement.”

The company also announced Wednesday that former Federal Deposit Insurance Corporation (FDIC) chairwoman Sheila Bair has joined Blooom as an advisory board member. Named the most powerful woman in the world in 2008 and 2009 by Forbes, Bair served as FDIC chairwoman under Presidents Barack Obama and George W. Bush. She was dubbed “the little guy’s protector in chief” and “a new sheriff of Wall Street” by TIME Magazine for her federal work during the Great Recession.

“I am very glad that blooom is doing its part to restore the good name of innovation and financial services by serving an overlooked segment of retirement savers,” Bair said in a release. “Blooom is an incredible tool that brings transparent pricing and un-conflicted advice to the millions of Americans who now, more than ever, need help keeping their costs low and choosing appropriate investments. I applaud blooom’s mission and progress,” Bair added.

The company has been on a solid hot streak as of late. In addition to a $4 million raise in October, Blooom won a $50,000 grant from the national LaunchKC competition and a $10,000 grant in a national Kauffman Foundation pitch contest. The company was also named a Top 10 Startup to Watch in 2016 by Startland News.

2016 Startups to Watch

stats here

Related Posts on Startland News

‘We have to allow for failure,’ says serial entrepreneur; Scale announces 7 startups in second cohort

Startland News’ Startup Road Trip series explores innovative and uncommon ideas finding success in rural America and Midwestern startup hubs outside the Kansas City metro. This series is possible thanks to the Ewing Marion Kauffman Foundation, which leads a collaborative, nationwide effort to identify and remove large and small barriers to new business creation. COLUMBIA,…

Comeback KC Ventures adds 9 more fellows to accelerate rapid-response health innovations

A global pandemic exposed both new challenges and the potential for disruptive solutions — putting Kansas City entrepreneurs at the forefront of rapid-fire change in the wake of an ongoing health crisis, said organizers of Comeback KC Ventures. Nine additional Kansas City tech startups are joining the fellowship program, its leaders said Wednesday, expanding upon…

Leanlab launches edtech certification with focus on accountability to classrooms

A new product certification from Leanlab Education means increased transparency for edtech companies — as well as added credibility for their work within schools. “We want to give teachers and school administrators a quick way to understand if an edtech product reflects the insights of educators, students, and parents — the true end users in education — and…

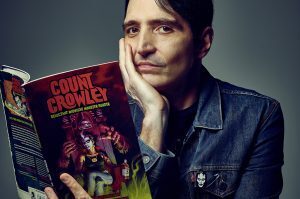

Actor David Dastmalchian fought his own demons; now the KC native is sending ’80s-inspired monsters to you

Growing up in Kansas City, David Dastmalchian was enamored with his hometown’s most shadowy corners: its fabled haunted houses, the shelves of Clint’s Comics, “Crematia Mortem’s Friday” on local TV, and even his Overland Park neighborhood’s mystical-seeming creeks and forests. Each of these childhood haunts planted a seed for the Hollywood actor’s latest project —…