Bipartisan support sends Kansas’ angel tax credits to governor’s desk

May 2, 2016 | Bobby Burch

After months of lobbying Kansas lawmakers, Kansas City area entrepreneurs are celebrating a legislative victory Monday that will extend a popular tax credit program for five more years.

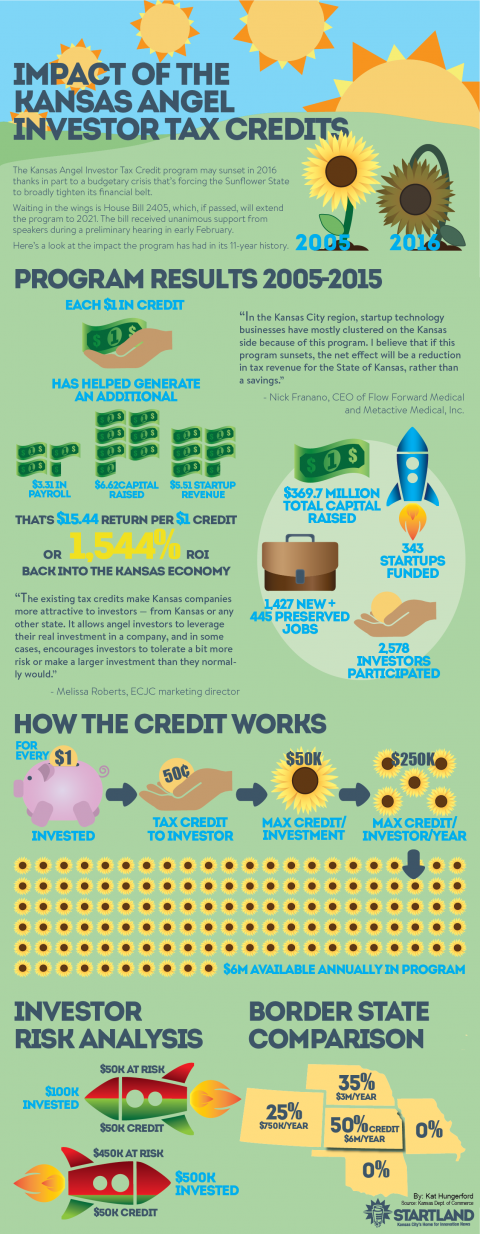

While now awaiting Gov. Sam Brownback’s signature, Kansas Senate Bill 149 will extend the life of the Angel Investor Tax Credits program through 2021. The $6 million annual program offers accredited investors a tax credit of up to $50,000 on an investment in a Kansas business, helping to mitigate risk and encourage investments.

“We have successfully preserved the largest — and in fact, the only — incentive created specifically to support Kansas entrepreneurs.” – Melissa Roberts.

Lawmakers in the Kansas House passed the measure 100 – 21 while the Senate voted 35 – 5 in favor of the bill. The largest complicating factor for the future of the program has been Kansas’ ongoing budget crisis. The Sunflower State is facing a more than $600 million budgetary shortfall, which resulted from the legislature’s slashing of personal income taxes in 2012 and 2013.

Entrepreneurs and other support organizations have rallied in support of the popular program, which has been tapped by more than 300 startups in its 11 years. In addition to spurring nearly $370 million in total capital raised, the tax credits have helped create more than 1,400 jobs and preserve nearly another 450. Since its inception in 2005, the program has provided $55.9 million in tax credits to investors funding Kansas startups.

Melissa Roberts, a key support organizer of the program, said that entrepreneurs’ vocal and consistent backing of the angel tax credits helped compel committee members to advance the bill.

“We have successfully preserved the largest — and in fact, the only — incentive created specifically to support Kansas entrepreneurs,” said Roberts, marketing director for the Enterprise Center of Johnson County. “Entrepreneurs and investors across the state made sure that their voices were heard in the state legislature. Their vocal support of this measure was key to ensuring that Angel Investment Tax Credits continue to be available to entrepreneurs through 2021.”

“The Angel Investor Tax Credit is an important incentive for drawing and retaining high growth startups to Kansas.” – Dennis Ridenour

The Kansas City Area Life Sciences Institute, Polsinelli, ClaimKit, Welltodo, ELIAS Animal Health and several other organizations banded together to offer vocal support of the angel tax credits. BioKansas CEO Dennis Ridenour’s organization was also apart of the lobbying effort to renew the program.

“This is a huge victory for entrepreneurship in Kansas, and for the life science and tech industries here in the state,” said Dennis Ridenour, CEO of BioKansas. “The Angel Investor Tax Credit is an important incentive for drawing and retaining high growth startups to Kansas. We are thrilled that the legislature realized that, and, despite an incredibly difficult legislative environment, took decisive steps to continue to offer this program.”

Nick Franano, CEO of two companies that have benefited from the angel tax credits, Metactive and Flow Forward Medical, testified at the Kansas State Capitol in favor of the program. He said the program should be emulated by others around the U.S., and that its renewal could be a big win for the region.

“We are closing in on an important victory,” Franano said. “The huge outpouring of support for the program from both the entrepreneurial and investor communities, and the large bipartisan majorities in both chambers in support of passage of the renewal, speaks to the value of the program for Kansans and the region.”

Startland News will keep you posted on any updates regarding the bill. For more information on the impact of the program, check the infographic below. To learn more about how it works, check out the bottom of this story.

Featured Business

2016 Startups to Watch

stats here

Related Posts on Startland News

Rif Raf Giraffe plays matchmaker for buildings, money and artists in Crossroads

Jason Harrington sees opportunity in places often overlooked – alleys, elevator shafts and the sides of brick buildings. For the artist better known as Rif Raf Giraffe, they’re vast canvasses, waiting to be filled with gallons and gallons of paint and passion. Harrington recently traversed the East Crossroads Arts District in search of more real…

Black & Veatch delivers first consumer product ever: Solarhood

After more than 100 years in business, engineering giant Black & Veatch has launched its first consumer product: Solarhood. Built through the B&V Growth Accelerator program, the company created Solarhood to streamline the process for homeowners to tap solar power. The Solarhood mobile and web-based app allow homeowners to access the feasibility of going solar,…

Two KC EdTech startups earn spots in latest LEANLAB cohort; launch set for August

It’s a highly selective process to join the fifth LEANLAB K-12 fellowship, said Katie Boody, but two Kansas City startups made the cut. K12 Perform and Base Academy of Music will join four other cohort members — hailing from the Midwest to Washington D.C. — in the August-to-November EdTech accelerator program. LEANLAB is partnering…

HechoKC cast in hand-made image of Chicano artist’s culture, family, community

Witnessing — and participating in — Kansas City’s renaissance has been amazing, said Luis Garcia, the longtime artist behind HechoKC. The Crossroads used to be a ghost town, said Garcia, who has been part of the KC scene since his years at the Kansas City Art Institute. He developed SPYN Studio, a branding and design…