Bipartisan support sends Kansas’ angel tax credits to governor’s desk

May 2, 2016 | Bobby Burch

After months of lobbying Kansas lawmakers, Kansas City area entrepreneurs are celebrating a legislative victory Monday that will extend a popular tax credit program for five more years.

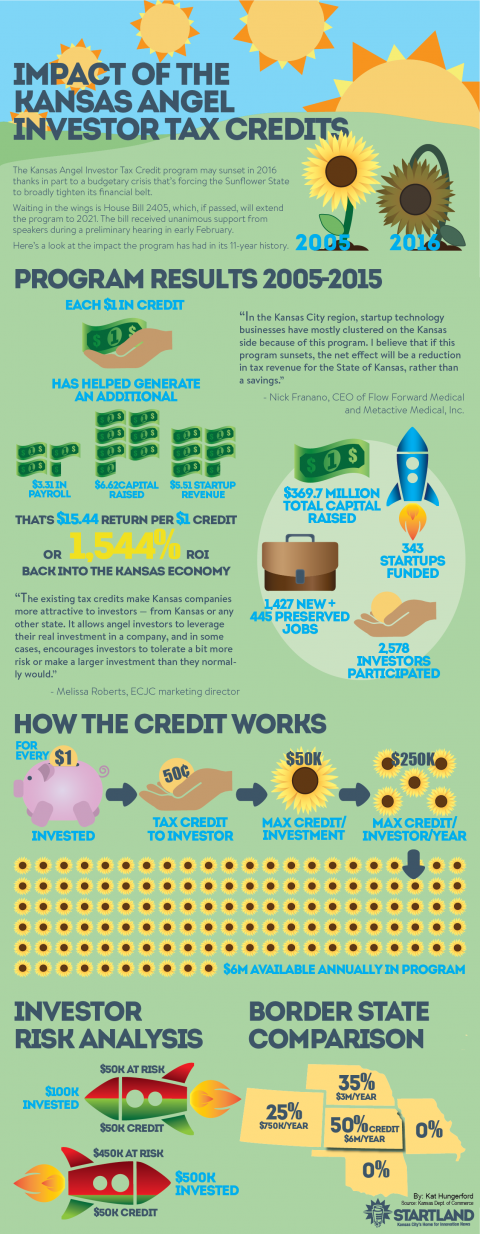

While now awaiting Gov. Sam Brownback’s signature, Kansas Senate Bill 149 will extend the life of the Angel Investor Tax Credits program through 2021. The $6 million annual program offers accredited investors a tax credit of up to $50,000 on an investment in a Kansas business, helping to mitigate risk and encourage investments.

“We have successfully preserved the largest — and in fact, the only — incentive created specifically to support Kansas entrepreneurs.” – Melissa Roberts.

Lawmakers in the Kansas House passed the measure 100 – 21 while the Senate voted 35 – 5 in favor of the bill. The largest complicating factor for the future of the program has been Kansas’ ongoing budget crisis. The Sunflower State is facing a more than $600 million budgetary shortfall, which resulted from the legislature’s slashing of personal income taxes in 2012 and 2013.

Entrepreneurs and other support organizations have rallied in support of the popular program, which has been tapped by more than 300 startups in its 11 years. In addition to spurring nearly $370 million in total capital raised, the tax credits have helped create more than 1,400 jobs and preserve nearly another 450. Since its inception in 2005, the program has provided $55.9 million in tax credits to investors funding Kansas startups.

Melissa Roberts, a key support organizer of the program, said that entrepreneurs’ vocal and consistent backing of the angel tax credits helped compel committee members to advance the bill.

“We have successfully preserved the largest — and in fact, the only — incentive created specifically to support Kansas entrepreneurs,” said Roberts, marketing director for the Enterprise Center of Johnson County. “Entrepreneurs and investors across the state made sure that their voices were heard in the state legislature. Their vocal support of this measure was key to ensuring that Angel Investment Tax Credits continue to be available to entrepreneurs through 2021.”

“The Angel Investor Tax Credit is an important incentive for drawing and retaining high growth startups to Kansas.” – Dennis Ridenour

The Kansas City Area Life Sciences Institute, Polsinelli, ClaimKit, Welltodo, ELIAS Animal Health and several other organizations banded together to offer vocal support of the angel tax credits. BioKansas CEO Dennis Ridenour’s organization was also apart of the lobbying effort to renew the program.

“This is a huge victory for entrepreneurship in Kansas, and for the life science and tech industries here in the state,” said Dennis Ridenour, CEO of BioKansas. “The Angel Investor Tax Credit is an important incentive for drawing and retaining high growth startups to Kansas. We are thrilled that the legislature realized that, and, despite an incredibly difficult legislative environment, took decisive steps to continue to offer this program.”

Nick Franano, CEO of two companies that have benefited from the angel tax credits, Metactive and Flow Forward Medical, testified at the Kansas State Capitol in favor of the program. He said the program should be emulated by others around the U.S., and that its renewal could be a big win for the region.

“We are closing in on an important victory,” Franano said. “The huge outpouring of support for the program from both the entrepreneurial and investor communities, and the large bipartisan majorities in both chambers in support of passage of the renewal, speaks to the value of the program for Kansans and the region.”

Startland News will keep you posted on any updates regarding the bill. For more information on the impact of the program, check the infographic below. To learn more about how it works, check out the bottom of this story.

Featured Business

2016 Startups to Watch

stats here

Related Posts on Startland News

Legal review: Supreme Court’s unanimous patent troll ruling, effects on KC

A recent ruling by the U.S. Supreme Court is being hailed as a significant blow to so-called patent trolls. Supreme Court justices unanimously ruled on Monday that patent infringement lawsuits may only be brought against defendants in the state in which the company is incorporated. The ruling dings “patent troll” plaintiffs that shop the country…

Focusing on fun, 1Week KC returns with Startup Crawl, yard games

A week long celebration of Kansas City entrepreneurship plans to build community among area innovators and residents with a festive atmosphere focused on fun. Featuring a startup pub crawl, a yard games tournament, educational events and more, 1Week KC is set for June 16 to 23 with events throughout the metro area. Previously presented by…

KCMO offers FAQ on its prospective Airbnb, Homeaway regulations

On Monday, the City of Kansas City, Mo. released newly-proposed rules on how it may regulate home-sharing services like Airbnb and Homeaway. City officials are planning to introduce the proposed ordinance at the Kansas City Planning Commission on June 6. After that, the proposal will head to the Kansas City Council, where it will likely…

Airbnb tells KCMO ‘go back to the drawing board’ on new proposed regulations

Airbnb and Homeaway hosts in Kansas City, Mo. are likely to see a set of new regulations for their properties soon. After more than a year of culling public input, the City of Kansas City, Mo. has drafted a proposed ordinance on how to regulate local home-sharing services like Airbnb and Homeaway. The proposal would…