SparkLabKC nixes spring program, eyes management change

March 29, 2016 | Bobby Burch

One of Kansas City’s top business accelerators is canceling its spring program amid a series of changes, including a potential management mixup.

Founded in 2012, SparkLabKC will not be offering what would’ve been its fourth spring program as it evaluates its future. Through three separate classes, the organization has helped accelerate 30 area startups with a three-month, mentor-led program that provides up to $18,000 in seed capital and business advisory services. SparkLabKC earned a 6 percent interest in each participating company in exchange for program services.

“The SparkLabKC founders are working to transition the accelerator to a new management group,” said Kevin Fryer, managing partner of SparkLabKC. “We are in active discussions to secure a management team that can move the program forward in the coming months.”

The accelerator was founded by Fryer, Ace Wagner, Don Hutchison, Mike Laddin and Al Eidson. The accelerator focused on early-stage tech startups working in industries that are driving the Kansas City region’s economy such as telecommunications, engineering, health care, agriculture and energy. The accelerator also offered an impressive network of more than 80 area entrepreneurs and businesspeople in a variety of tech businesses.

It’s now unclear whether the management change will affect the accelerator’s office space in downtown Kansas City. Startups in the program tapped the space as a collaborative environment to cultivate ideas with other founders. Fryer said that the potential management companies he’s speaking with have more than enough space to house SparkLabKC.

In its three years, SparkLabKC has helped launch such firms as Life Equals, Lending Standard, Pop Bookings and Lucky Orange. Arguably the accelerator’s most successful graduate has been CouponCloud, which last year partnered with Kansas City-based DST Systems Inc. to boost its coupon redemption and processing technology.

SparkLabKC is among only a handful of accelerators in the Kansas City area. Other programs include the Techstars-led Sprint Accelerator, Think Big and BetaBlox.

Here’s a summary of SparkLabKC’s performance:

- Three years, 30 graduate companies

- 23 companies are still active while seven have failed

- The 30 companies have collectively $2.84 million in capital

- SparkLabKC firms have tapped $189,000 in Digital Sandbox KC grants

- SparkLabKC firms have used about $1 million in Kansas’ Angel Investor Tax Credits

Startland News will report on updates regarding SparkLabKC as they become available.

Featured Business

2016 Startups to Watch

stats here

Related Posts on Startland News

DevOpsDays brings two-day grassroots tech conference back to Kansas City

DevOpsDays KC is returning this week with an open spaces concept wherein audience members at the two-day conference vote on the topics to cover in real time, said Ryan McNair. Topics with the most votes create zones in the space in which the audience can flow freely from each area. “If you don’t like it,…

Privacy in practice: Responding to daily cyber threats sharpens Polsinelli tech team

Editor’s note: The following content is sponsored by Polsinelli PC but independently produced by Startland News. We see the fallout nearly every day. Another company, government or celebrity that’s been technologically compromised, prompting officials to scramble on how to best calm customers, citizens and stakeholders. And when you lead one of the nation’s top cybersecurity…

Pint-sized perspective: KC’s Little Hoots takes nostalgia-capturing tech to MIT

From the cute and comedic to the whimsical and wise, every parent can pinpoint a Little Hoots moment that relates to their personal adventure in child-rearing, said Lacey Ellis, founder and CEO of the Kansas City-birthed mobile app that recently turned heads at MIT. “If a picture is worth a thousand words, a hoot is…

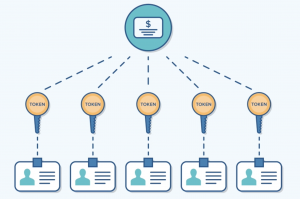

LaunchKC winner bringing cryptocurrency into the investment game with Liquifi

A blockchain-enabled solution from Venture360, called Liquifi, aims to unfreeze startups paralyzed by a lack of access to capital, Rachael Qualls said with excitement. “The main reason more people don’t invest in private companies is there is no way to get money out,” said Qualls, CEO of Venture360. “On average money is tied up for…