Kansas’ angel tax credits sprint to legal finish line

March 22, 2016 | Bobby Burch

The Kansas House of Representatives nearly unanimously agreed that the state’s Angel Investor Tax Credits program must continue to boost early-stage businesses.

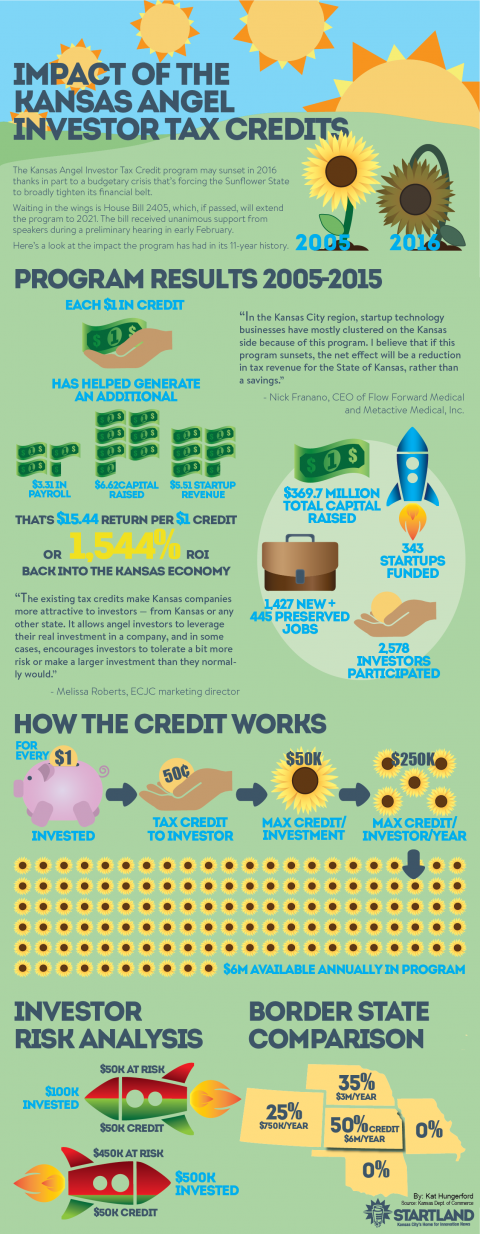

The House voted 122 to 3 in favor of a measure that will extend the life of the $6 million program until 2021. Angel investor tax credits, which are set to expire in 2016, offer accredited investors a tax credit of up to $50,000 on an investment in a Kansas business, helping to mitigate risk and encourage investments.

The bill now goes into conference committee to resolve any disagreements in language. After that, the bill heads to the Kansas Gov. Sam Brownback’s desk for a signature to be made law. The tax credits program is now a part of omnibus tax measure SB 149.

Arguably the biggest win for supporters is that lawmakers retained its current allocation levels of $6 million per year. That allocation is more than double any nearby state offering a similar program. Missouri doesn’t offer angel tax credits, further providing Kansas an advantage in attracting businesses to the state.

The Senate, which already voted on the measure, unanimously supported the bill in a 40 to 0 vote. The three Kansas House members voting against the bill were: Amanda Grosserode, R-Lenexa, Michael Houser, R-Columbus, and Craig McPherson, R-Overland Park.

Kansas’ more than $600 million budgetary shortfall — which resulted from the legislature’s slashing of personal income taxes in 2012 and 2013 — has been the largest complicating factor for the future of the tax credit.

Entrepreneurs and other support organizations have rallied in support of the popular program, which has been tapped by more than 300 startups in its 11 years. In addition to spurring nearly $370 million in total capital raised, the tax credits have helped create more than 1,400 jobs and preserve nearly another 450. Since its inception in 2005, the program has provided $55.9 million in tax credits to investors funding Kansas startups.

Startland News will keep you posted on any updates regarding the bill. For more information on the impact of the program, check the infographic below. To learn more about how it works, check out the bottom of this story.

2016 Startups to Watch

stats here

Related Posts on Startland News

Food, IoT, blockchain and AgTech startups join 2018 Sprint Accelerator class

With its fifth cohort of early-stage firms, the Sprint Accelerator scoured the globe for a brood of ag, food and tech startups that aim to leverage area corporate partnerships. The Crossroads Arts District-based accelerator announced on Monday nine new startups that will participate in its 90-day, mentor-driven program. The accelerator pairs startups with wireless carrier…

Rockhurst’s Meet the Makers: Look beyond the cubicle walls

Don’t ignore magical timing within the entrepreneur community, said marketing manager-turned-children’s book author Audrey Masoner. “Kansas City is a place where anything can happen, and you really want to keep your eyes open for connections,” Masoner told a crowd gathered Wednesday for Rockhurst University’s Meet the Makers speaker series. “It’s small enough to be very…

Chef Celina Tio embraces her celebrity brand, welcomes disruptive discomfort

Sitting down to discuss her career a few hours before a Thursday evening rush at The Belfry, celebrity chef and entrepreneur Celina Tio is all business. She’s heard (and answered) every biographical question before. Yet Tio’s eyes gleam and a smile quickly spreads across her face when the conversation turns to her customers at the…

Garmin CEO reveals startup origins, tech hiring challenges, culture of innovation

It began like any other startup, said Clifton Pemble, Garmin’s sixth employee and now CEO of the $11 billion GPS tech firm. “I joined Garmin and it was literally just days later that we were gathered in a little place over at 95th and Pflumm — two rooms in a small strip mall kind of…