Kansas’ angel tax credits sprint to legal finish line

March 22, 2016 | Bobby Burch

The Kansas House of Representatives nearly unanimously agreed that the state’s Angel Investor Tax Credits program must continue to boost early-stage businesses.

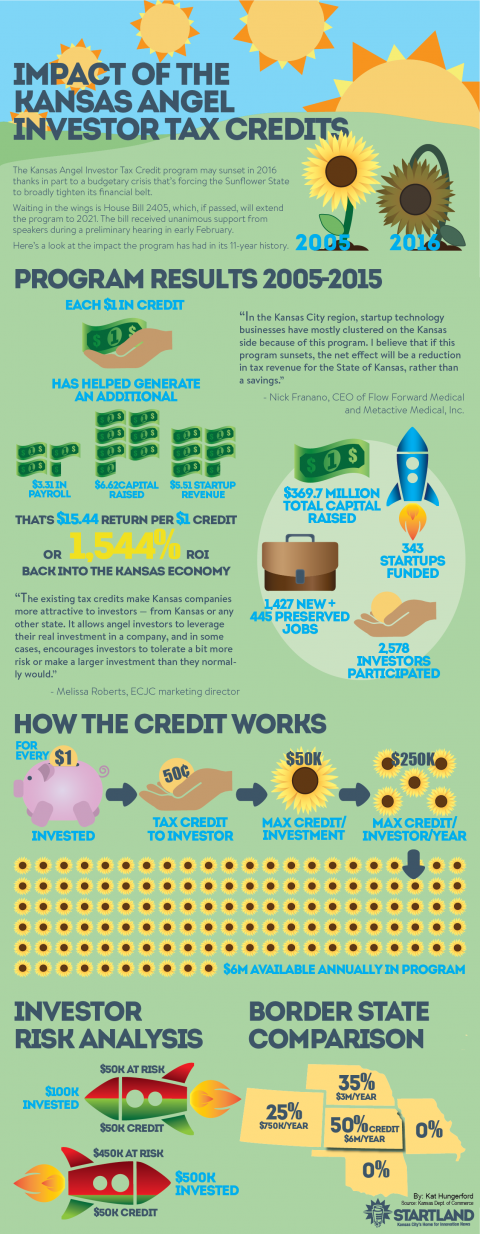

The House voted 122 to 3 in favor of a measure that will extend the life of the $6 million program until 2021. Angel investor tax credits, which are set to expire in 2016, offer accredited investors a tax credit of up to $50,000 on an investment in a Kansas business, helping to mitigate risk and encourage investments.

The bill now goes into conference committee to resolve any disagreements in language. After that, the bill heads to the Kansas Gov. Sam Brownback’s desk for a signature to be made law. The tax credits program is now a part of omnibus tax measure SB 149.

Arguably the biggest win for supporters is that lawmakers retained its current allocation levels of $6 million per year. That allocation is more than double any nearby state offering a similar program. Missouri doesn’t offer angel tax credits, further providing Kansas an advantage in attracting businesses to the state.

The Senate, which already voted on the measure, unanimously supported the bill in a 40 to 0 vote. The three Kansas House members voting against the bill were: Amanda Grosserode, R-Lenexa, Michael Houser, R-Columbus, and Craig McPherson, R-Overland Park.

Kansas’ more than $600 million budgetary shortfall — which resulted from the legislature’s slashing of personal income taxes in 2012 and 2013 — has been the largest complicating factor for the future of the tax credit.

Entrepreneurs and other support organizations have rallied in support of the popular program, which has been tapped by more than 300 startups in its 11 years. In addition to spurring nearly $370 million in total capital raised, the tax credits have helped create more than 1,400 jobs and preserve nearly another 450. Since its inception in 2005, the program has provided $55.9 million in tax credits to investors funding Kansas startups.

Startland News will keep you posted on any updates regarding the bill. For more information on the impact of the program, check the infographic below. To learn more about how it works, check out the bottom of this story.

2016 Startups to Watch

stats here

Related Posts on Startland News

Coming to Leawood: Blade & Timber hopes to stick another win with second axe throwing space

Kansas City comes first, said Matt Baysinger. And that means providing cutting-edge experiences like Blade & Timber to folks across the metro. “As we were looking at expansion — and obviously we’re looking at cities outside of the metro and outside of Kansas — it made so much sense for us to say, ‘This is…

App snaps pics of items to ease moving process, MovinHouz founders say

What started as a couple of bad moving experiences developed into a mobile app to simplify the relocation process, said MovinHouz co-founders. Dominic Klobe and Chris Perrin, co-founders of Olathe-based MovinHouz, a tech startup incubated at Digital Sandbox KC, are building an app that connects moving companies to customers in need of their services, Klobe…

Student investors hope to make inroads with KC founders through pitch day

A group of student investors in the Kansas City University Venture Program are working to jump start deal flow and create relationships with Kansas City entrepreneurs. Launched in 2017, the student-led fund is hosting a pitch event to start a dialogue with area startups in hopes of finding their newest investment deals, said Nate Crosser, a…

NBA hires Alight Analytics to collect, analyze data from fans’ social engagement

The volume of data created within a professional sports team’s fan base is enormous, said Matt Hertig, chief executive officer of Alight Analytics. “Being able to see all of that data together across all of the popular social channels — from Facebook, Youtube, Twitter, Instagram, Snapchat — in one place and really understand the correlation…