Kansas’ angel tax credits sprint to legal finish line

March 22, 2016 | Bobby Burch

The Kansas House of Representatives nearly unanimously agreed that the state’s Angel Investor Tax Credits program must continue to boost early-stage businesses.

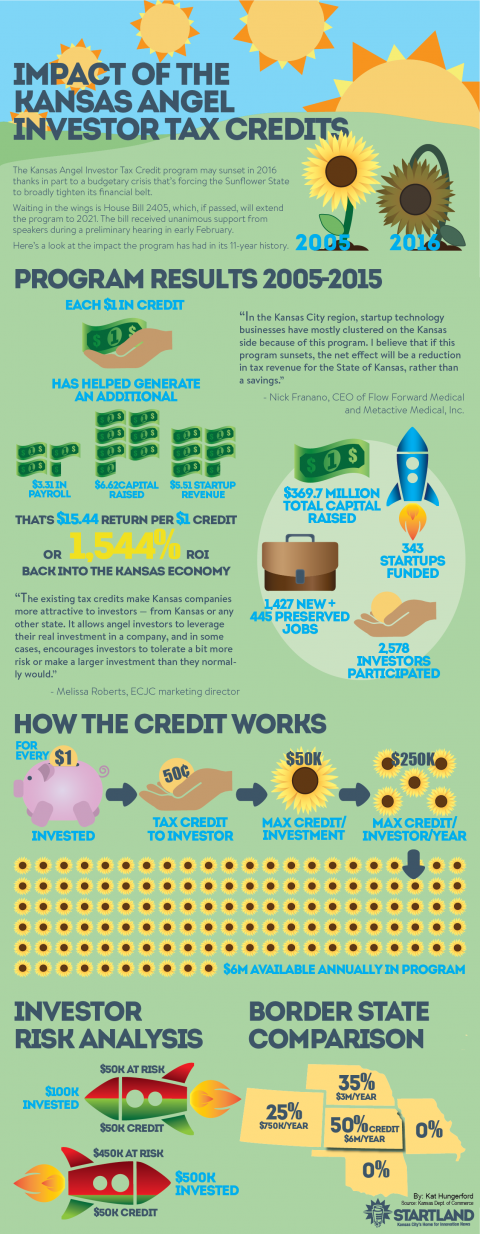

The House voted 122 to 3 in favor of a measure that will extend the life of the $6 million program until 2021. Angel investor tax credits, which are set to expire in 2016, offer accredited investors a tax credit of up to $50,000 on an investment in a Kansas business, helping to mitigate risk and encourage investments.

The bill now goes into conference committee to resolve any disagreements in language. After that, the bill heads to the Kansas Gov. Sam Brownback’s desk for a signature to be made law. The tax credits program is now a part of omnibus tax measure SB 149.

Arguably the biggest win for supporters is that lawmakers retained its current allocation levels of $6 million per year. That allocation is more than double any nearby state offering a similar program. Missouri doesn’t offer angel tax credits, further providing Kansas an advantage in attracting businesses to the state.

The Senate, which already voted on the measure, unanimously supported the bill in a 40 to 0 vote. The three Kansas House members voting against the bill were: Amanda Grosserode, R-Lenexa, Michael Houser, R-Columbus, and Craig McPherson, R-Overland Park.

Kansas’ more than $600 million budgetary shortfall — which resulted from the legislature’s slashing of personal income taxes in 2012 and 2013 — has been the largest complicating factor for the future of the tax credit.

Entrepreneurs and other support organizations have rallied in support of the popular program, which has been tapped by more than 300 startups in its 11 years. In addition to spurring nearly $370 million in total capital raised, the tax credits have helped create more than 1,400 jobs and preserve nearly another 450. Since its inception in 2005, the program has provided $55.9 million in tax credits to investors funding Kansas startups.

Startland News will keep you posted on any updates regarding the bill. For more information on the impact of the program, check the infographic below. To learn more about how it works, check out the bottom of this story.

2016 Startups to Watch

stats here

Related Posts on Startland News

Selling ‘the infinite commodity’: Farmobile leverages blockchain to build secure data store

With more than a million acres of field data amassed by Farmobile, farmers now need an exchange to securely connect them with buyers of the digital machine and agronomic information they’ve harvested, said Jason Tatge. A newly opened Farmobile DataStore, which leverages elements of blockchain technology fueled by Intel Sawtooth and Amazon Web Services to…

Rif Raf Giraffe plays matchmaker for buildings, money and artists in Crossroads

Jason Harrington sees opportunity in places often overlooked – alleys, elevator shafts and the sides of brick buildings. For the artist better known as Rif Raf Giraffe, they’re vast canvasses, waiting to be filled with gallons and gallons of paint and passion. Harrington recently traversed the East Crossroads Arts District in search of more real…

Black & Veatch delivers first consumer product ever: Solarhood

After more than 100 years in business, engineering giant Black & Veatch has launched its first consumer product: Solarhood. Built through the B&V Growth Accelerator program, the company created Solarhood to streamline the process for homeowners to tap solar power. The Solarhood mobile and web-based app allow homeowners to access the feasibility of going solar,…

Two KC EdTech startups earn spots in latest LEANLAB cohort; launch set for August

It’s a highly selective process to join the fifth LEANLAB K-12 fellowship, said Katie Boody, but two Kansas City startups made the cut. K12 Perform and Base Academy of Music will join four other cohort members — hailing from the Midwest to Washington D.C. — in the August-to-November EdTech accelerator program. LEANLAB is partnering…