Kansas’ angel tax credits sprint to legal finish line

March 22, 2016 | Bobby Burch

The Kansas House of Representatives nearly unanimously agreed that the state’s Angel Investor Tax Credits program must continue to boost early-stage businesses.

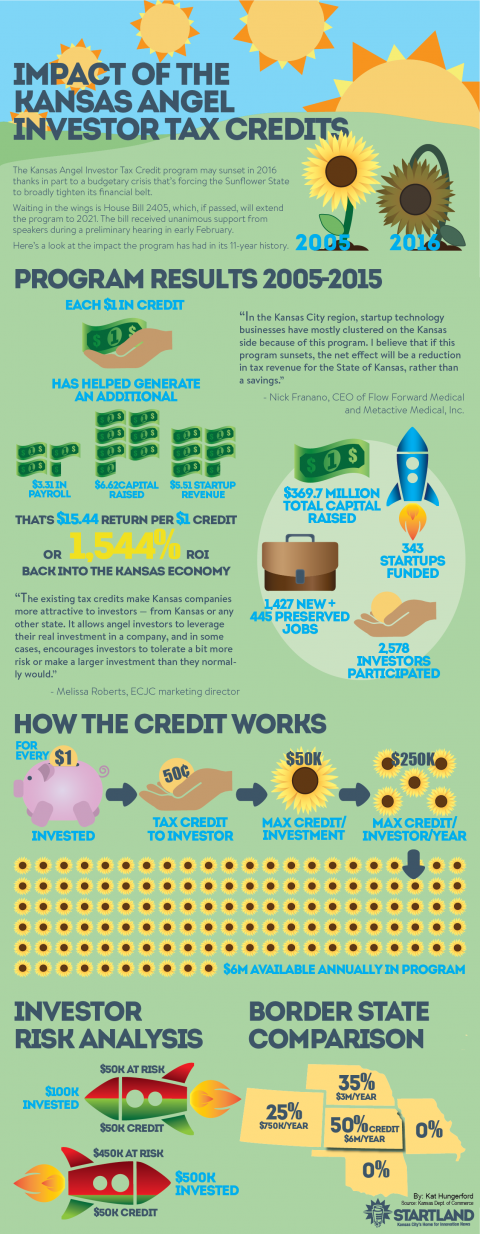

The House voted 122 to 3 in favor of a measure that will extend the life of the $6 million program until 2021. Angel investor tax credits, which are set to expire in 2016, offer accredited investors a tax credit of up to $50,000 on an investment in a Kansas business, helping to mitigate risk and encourage investments.

The bill now goes into conference committee to resolve any disagreements in language. After that, the bill heads to the Kansas Gov. Sam Brownback’s desk for a signature to be made law. The tax credits program is now a part of omnibus tax measure SB 149.

Arguably the biggest win for supporters is that lawmakers retained its current allocation levels of $6 million per year. That allocation is more than double any nearby state offering a similar program. Missouri doesn’t offer angel tax credits, further providing Kansas an advantage in attracting businesses to the state.

The Senate, which already voted on the measure, unanimously supported the bill in a 40 to 0 vote. The three Kansas House members voting against the bill were: Amanda Grosserode, R-Lenexa, Michael Houser, R-Columbus, and Craig McPherson, R-Overland Park.

Kansas’ more than $600 million budgetary shortfall — which resulted from the legislature’s slashing of personal income taxes in 2012 and 2013 — has been the largest complicating factor for the future of the tax credit.

Entrepreneurs and other support organizations have rallied in support of the popular program, which has been tapped by more than 300 startups in its 11 years. In addition to spurring nearly $370 million in total capital raised, the tax credits have helped create more than 1,400 jobs and preserve nearly another 450. Since its inception in 2005, the program has provided $55.9 million in tax credits to investors funding Kansas startups.

Startland News will keep you posted on any updates regarding the bill. For more information on the impact of the program, check the infographic below. To learn more about how it works, check out the bottom of this story.

2016 Startups to Watch

stats here

Related Posts on Startland News

Artist Vi Tran to KC-based innovators: Wipe ‘local’ label from your vocabulary

Some roots are best left behind, but not forgotten, said multi-faceted Kansas City artist Vi Tran. Others are worth holding close. Speaking at Startland’s recent Innovation Exchange, the actor, playwright, musician and owner of The Buffalo Room decried the idea that innovators who choose to stay in places like Kansas City are any less worthy…

The not-so-secret Sauce behind KC hip hop entrepreneur’s success: Authenticity

Royce “Sauce” Handy wears his influences and inspiration like pins on the outside of his well-worn jean jacket. The KCK-born hip hop entrepreneur embraces his identity: A collector of Goosebumps books. A student of history. A fan of 1990s family sitcoms. And he’s unapologetically black. His lips twist into a smile and his eyes brighten…

Startup Hustle podcast duo pledging $50K in Full Scale tech resources at Pure Pitch Rally

Early stage businesses need more than cash — they need the tools to grow, said the hosts of the KC-based Startup Hustle podcast. “Good ideas in startups move faster when they’re supported by successful business people in the community,” said podcast co-host Matt DeCoursey, announcing the plan late Wednesday to award $50,000 in tech resources,…

ProjectUK introducing specialty accelerator’s latest cohort Oct. 10 at Travois

Project United Knowledge is the only Kansas City accelerator that truly fosters collaboration between entrepreneurs and those in the industry establishment, said Quest Moffat. “It’s the biggest and most dramatic reason that we’re different from other accelerators in the Midwest region,” said Moffat, ProjectUK founder. “Co-building is where the corporation and the people that run…