Kansas’ angel tax credits sprint to legal finish line

March 22, 2016 | Bobby Burch

The Kansas House of Representatives nearly unanimously agreed that the state’s Angel Investor Tax Credits program must continue to boost early-stage businesses.

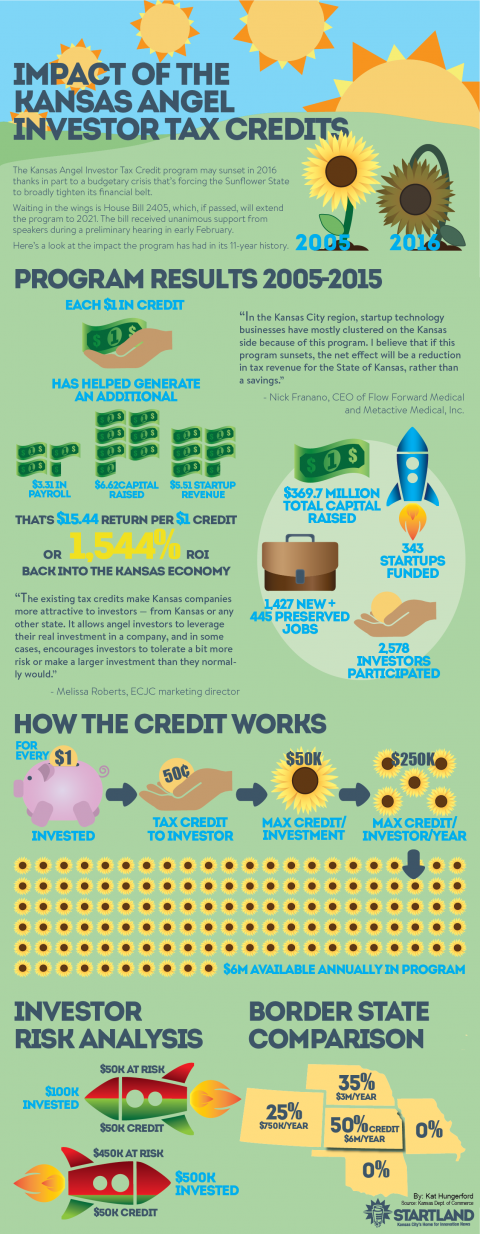

The House voted 122 to 3 in favor of a measure that will extend the life of the $6 million program until 2021. Angel investor tax credits, which are set to expire in 2016, offer accredited investors a tax credit of up to $50,000 on an investment in a Kansas business, helping to mitigate risk and encourage investments.

The bill now goes into conference committee to resolve any disagreements in language. After that, the bill heads to the Kansas Gov. Sam Brownback’s desk for a signature to be made law. The tax credits program is now a part of omnibus tax measure SB 149.

Arguably the biggest win for supporters is that lawmakers retained its current allocation levels of $6 million per year. That allocation is more than double any nearby state offering a similar program. Missouri doesn’t offer angel tax credits, further providing Kansas an advantage in attracting businesses to the state.

The Senate, which already voted on the measure, unanimously supported the bill in a 40 to 0 vote. The three Kansas House members voting against the bill were: Amanda Grosserode, R-Lenexa, Michael Houser, R-Columbus, and Craig McPherson, R-Overland Park.

Kansas’ more than $600 million budgetary shortfall — which resulted from the legislature’s slashing of personal income taxes in 2012 and 2013 — has been the largest complicating factor for the future of the tax credit.

Entrepreneurs and other support organizations have rallied in support of the popular program, which has been tapped by more than 300 startups in its 11 years. In addition to spurring nearly $370 million in total capital raised, the tax credits have helped create more than 1,400 jobs and preserve nearly another 450. Since its inception in 2005, the program has provided $55.9 million in tax credits to investors funding Kansas startups.

Startland News will keep you posted on any updates regarding the bill. For more information on the impact of the program, check the infographic below. To learn more about how it works, check out the bottom of this story.

2016 Startups to Watch

stats here

Related Posts on Startland News

Sickweather spent 8 years and $100K+ to obtain a patent; Is IP protection worth the cost?

Graham Dodge wanted to check a box for investors seeking security for his crowdsourced sickness forecasting startup Sickweather, he said. Obtaining a patent for the technology, however, proved a tougher task to chart. “We just wanted to protect ourselves to build value in the company,” said Dodge, CEO of Sickweather, as well as Garnish Health,…

RiskGenius announces Series B, partnerships with trio of world’s largest insurance carriers

Customers are pushing for the growth of RiskGenius, a top Kansas City startup providing software-based natural language processing tools for improved quality and accuracy in the insurance industry, said CEO Chris Cheatham. RiskGenius announced Monday an undisclosed Series B round led by Hudson Structured Capital Management Ltd., doing business as HSCM Bermuda. The financing round…

Value rich: Crema shifts gears in startup support approach as agency evolves

Providing scaling companies with new pathways to learning is the latest objective for Crema, said George Brooks, detailing the digital agency’s constant evolution. “We had this opportunity with the brands that we’ve been working with over the past few years to basically figure out, ‘Hey, how do we increase the value of your company?’” explained…