Kansas’ angel tax credits sprint to legal finish line

March 22, 2016 | Bobby Burch

The Kansas House of Representatives nearly unanimously agreed that the state’s Angel Investor Tax Credits program must continue to boost early-stage businesses.

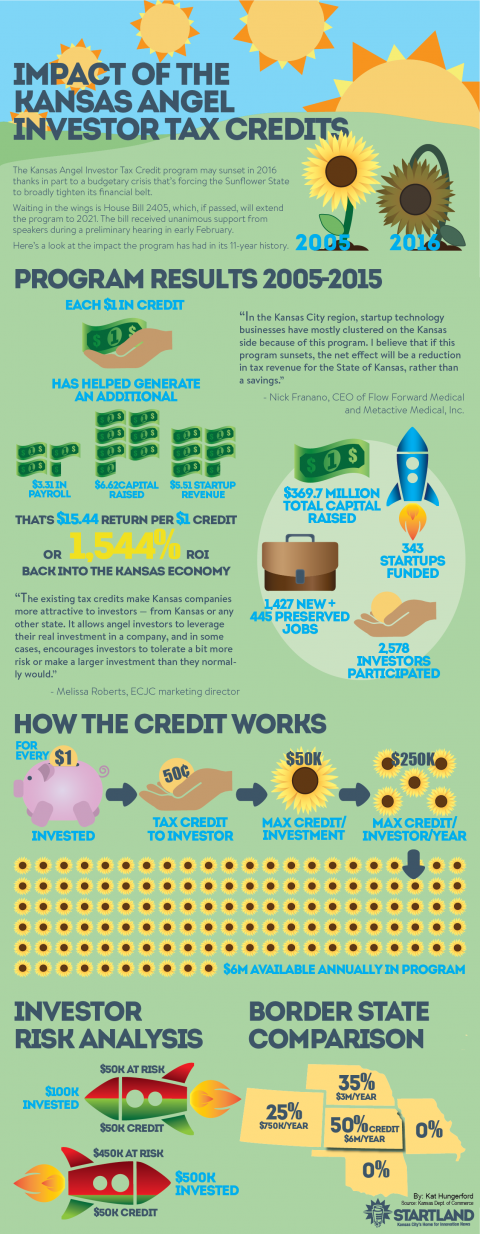

The House voted 122 to 3 in favor of a measure that will extend the life of the $6 million program until 2021. Angel investor tax credits, which are set to expire in 2016, offer accredited investors a tax credit of up to $50,000 on an investment in a Kansas business, helping to mitigate risk and encourage investments.

The bill now goes into conference committee to resolve any disagreements in language. After that, the bill heads to the Kansas Gov. Sam Brownback’s desk for a signature to be made law. The tax credits program is now a part of omnibus tax measure SB 149.

Arguably the biggest win for supporters is that lawmakers retained its current allocation levels of $6 million per year. That allocation is more than double any nearby state offering a similar program. Missouri doesn’t offer angel tax credits, further providing Kansas an advantage in attracting businesses to the state.

The Senate, which already voted on the measure, unanimously supported the bill in a 40 to 0 vote. The three Kansas House members voting against the bill were: Amanda Grosserode, R-Lenexa, Michael Houser, R-Columbus, and Craig McPherson, R-Overland Park.

Kansas’ more than $600 million budgetary shortfall — which resulted from the legislature’s slashing of personal income taxes in 2012 and 2013 — has been the largest complicating factor for the future of the tax credit.

Entrepreneurs and other support organizations have rallied in support of the popular program, which has been tapped by more than 300 startups in its 11 years. In addition to spurring nearly $370 million in total capital raised, the tax credits have helped create more than 1,400 jobs and preserve nearly another 450. Since its inception in 2005, the program has provided $55.9 million in tax credits to investors funding Kansas startups.

Startland News will keep you posted on any updates regarding the bill. For more information on the impact of the program, check the infographic below. To learn more about how it works, check out the bottom of this story.

2016 Startups to Watch

stats here

Related Posts on Startland News

Just-launched retail hub gets first tenant, battling ‘blight of the heart’ on Troost corner

‘We are each other’s bootstraps’ Transforming a long-vacant building along Troost into a space for neighborhood small businesses is about empowering the entrepreneurs already living and working in the east side community, said Father Justin Mathews. The newly unveiled RS Impact Exchange — built within the renovated, 1920-built Baker Shoe Building at 3108-3116 Troost Ave.…

Hog Island to Parkville: Justus Drugstore owners docking new seafood concept in historic Parkville

The Parker Hollow builds on Chef Jonathan Justus’ mission to put small town Missouri on the menu PARKVILLE, Mo. — A bright yellow, nearly 150-year-old former Italian restaurant could become Kansas City’s go-to seafood destination with help from the world-renowned hometown culinary team behind Justus Drugstore and Black Dirt. Chef Jonathan Justus and his wife…

KC’s Enduralock secures $1.25M SpaceWERX contract to boost satellite docking tech

A Lenexa tech company has been selected by the innovation arm of the U.S. Space Force to address one of the most-pressing challenges facing military operations in the skies and beyond. Enduralock just announced its selection for a $1.25 million contract aimed at using the company’s new connector system, OneLink, to enable modular in-space servicing…

You can’t plan for this: ‘Mr K’ finalists wary of another ‘wrench into the face’ from Washington

An upended national political and economic climate has rippled down to Main Street, acknowledged leaders of this year’s Top 10 Small Businesses, bringing concerns about racism, DEI backlash, tariffs, and supply chain disruptions to Kansas City’s front door. “We’ve had people come into the shop and harass our employees, our customers,” explained Dulcinea Herrera —…