Kansas’ angel tax credits sprint to legal finish line

March 22, 2016 | Bobby Burch

The Kansas House of Representatives nearly unanimously agreed that the state’s Angel Investor Tax Credits program must continue to boost early-stage businesses.

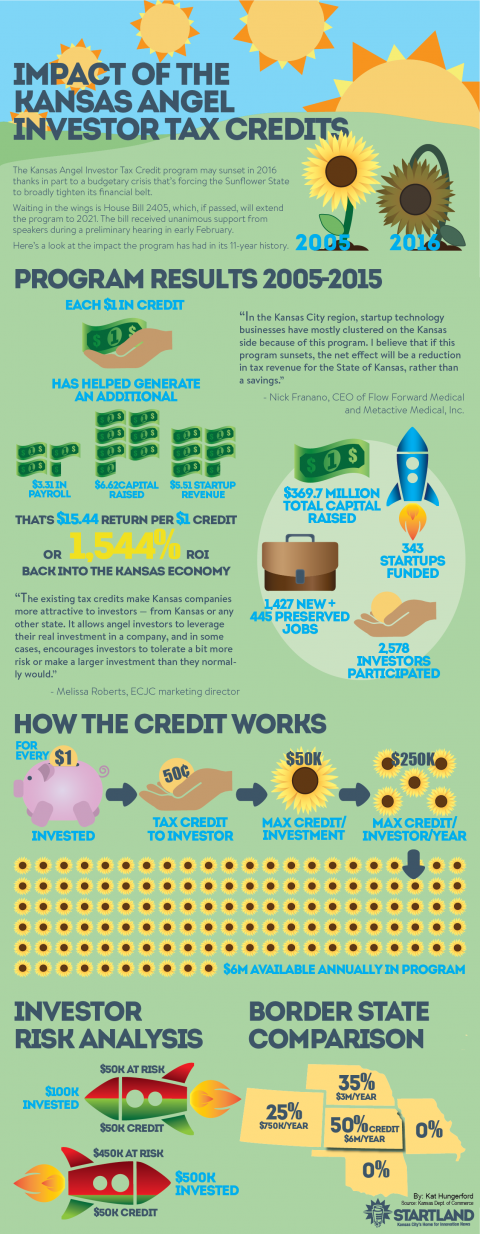

The House voted 122 to 3 in favor of a measure that will extend the life of the $6 million program until 2021. Angel investor tax credits, which are set to expire in 2016, offer accredited investors a tax credit of up to $50,000 on an investment in a Kansas business, helping to mitigate risk and encourage investments.

The bill now goes into conference committee to resolve any disagreements in language. After that, the bill heads to the Kansas Gov. Sam Brownback’s desk for a signature to be made law. The tax credits program is now a part of omnibus tax measure SB 149.

Arguably the biggest win for supporters is that lawmakers retained its current allocation levels of $6 million per year. That allocation is more than double any nearby state offering a similar program. Missouri doesn’t offer angel tax credits, further providing Kansas an advantage in attracting businesses to the state.

The Senate, which already voted on the measure, unanimously supported the bill in a 40 to 0 vote. The three Kansas House members voting against the bill were: Amanda Grosserode, R-Lenexa, Michael Houser, R-Columbus, and Craig McPherson, R-Overland Park.

Kansas’ more than $600 million budgetary shortfall — which resulted from the legislature’s slashing of personal income taxes in 2012 and 2013 — has been the largest complicating factor for the future of the tax credit.

Entrepreneurs and other support organizations have rallied in support of the popular program, which has been tapped by more than 300 startups in its 11 years. In addition to spurring nearly $370 million in total capital raised, the tax credits have helped create more than 1,400 jobs and preserve nearly another 450. Since its inception in 2005, the program has provided $55.9 million in tax credits to investors funding Kansas startups.

Startland News will keep you posted on any updates regarding the bill. For more information on the impact of the program, check the infographic below. To learn more about how it works, check out the bottom of this story.

2016 Startups to Watch

stats here

Related Posts on Startland News

New lab hopes to boost digital inclusion in Kansas City

A new computer lab in Northeast Kansas City hopes to serve as a tech oasis in a digital desert among low-income households. Google donated and opened the new lab Monday in Chouteau Court, furthering the company’s mission to help bridge the area’s digital divide through education about computers and Internet use. Rachel Hack Merlo, Google…

Lantern scores big with Sporting Kansas City deal

Tech firm Lantern Software’s mobile app hit the right pitch with its hometown soccer team. The startup, located in Kansas City, Kan., recently partnered with Sporting Kansas City to offer its mobile concessions ordering platform. The deal, effective Saturday, will allow fans in Sporting KC’s Boulevard Members Club to order and pay for concessions on…

Scarcity of women, parents in startups offers research opportunity

It’s no secret that — like any business — an entrepreneurial ecosystem is disadvantaged without a diverse set of players. But hurdles such as late night meetings and male-dominated culture at startups create barriers to entry for two specific groups: women and parents. That’s why researchers at the Ewing Marion Kauffman Foundation are taking another…