Kansas’ angel tax credits sprint to legal finish line

March 22, 2016 | Bobby Burch

The Kansas House of Representatives nearly unanimously agreed that the state’s Angel Investor Tax Credits program must continue to boost early-stage businesses.

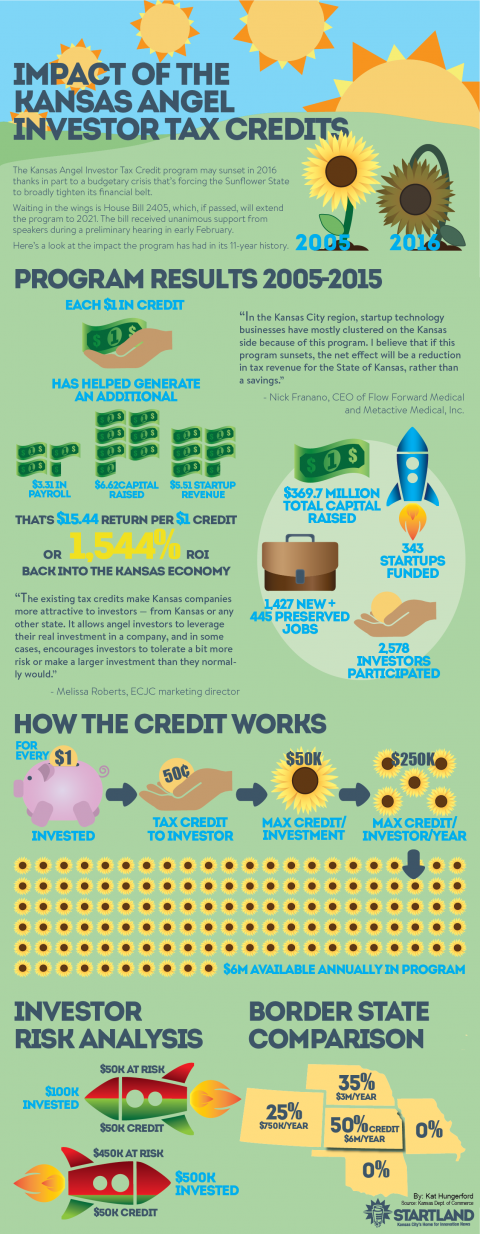

The House voted 122 to 3 in favor of a measure that will extend the life of the $6 million program until 2021. Angel investor tax credits, which are set to expire in 2016, offer accredited investors a tax credit of up to $50,000 on an investment in a Kansas business, helping to mitigate risk and encourage investments.

The bill now goes into conference committee to resolve any disagreements in language. After that, the bill heads to the Kansas Gov. Sam Brownback’s desk for a signature to be made law. The tax credits program is now a part of omnibus tax measure SB 149.

Arguably the biggest win for supporters is that lawmakers retained its current allocation levels of $6 million per year. That allocation is more than double any nearby state offering a similar program. Missouri doesn’t offer angel tax credits, further providing Kansas an advantage in attracting businesses to the state.

The Senate, which already voted on the measure, unanimously supported the bill in a 40 to 0 vote. The three Kansas House members voting against the bill were: Amanda Grosserode, R-Lenexa, Michael Houser, R-Columbus, and Craig McPherson, R-Overland Park.

Kansas’ more than $600 million budgetary shortfall — which resulted from the legislature’s slashing of personal income taxes in 2012 and 2013 — has been the largest complicating factor for the future of the tax credit.

Entrepreneurs and other support organizations have rallied in support of the popular program, which has been tapped by more than 300 startups in its 11 years. In addition to spurring nearly $370 million in total capital raised, the tax credits have helped create more than 1,400 jobs and preserve nearly another 450. Since its inception in 2005, the program has provided $55.9 million in tax credits to investors funding Kansas startups.

Startland News will keep you posted on any updates regarding the bill. For more information on the impact of the program, check the infographic below. To learn more about how it works, check out the bottom of this story.

2016 Startups to Watch

stats here

Related Posts on Startland News

Mental health startup Start Talking goes mobile, scores $150K in tax credits

Depression affects about one out of every 10 Americans, including at one time Start Talking founder Mark Nolte. While a rough time in his life, Nolte’s struggle with depression in 2010 eventually led him to launch a venture that’s more easily connecting people with the help they need. Lenexa-based Start Talking offers patients a psychotherapy…

Video: KC women in tech talk challenges, engagement

While Kansas City ranks as a top locale for ladies in technology, there’s still work to be done to create more gender diversity in the industry. This video — created in collaboration with Kansas City Public Television and videographer Brad Austin — explores some of the challenges that women face in a male-dominated field and how to engage more women…

3 local businessmen named EY’s Entrepreneur of the Year

Three Kansas City area businesspeople recently snagged one of the most prestigious awards for entrepreneurs. EY announced Monday the winners of the Entrepreneur of the Year 2015 for the central Midwest, which included three businessmen from the Kansas City metro area. Those receiving the commendation included: Jody Brazil, CEO of FireMon; Matthew Perry, President of…

Women flex their tech muscles at KC conference

Framed by a LEGO guitar and robotic vehicle, Rheanne Walton and Emma Howard anxiously review notes at their podium as dozens of technology experts await their pitch. The middle-school students are visiting the Kansas City Developers Conference to share the story of their all-girl robotics team, MindSTEM, and how it competes in the FIRST LEGO…