Kansas’ angel tax credits sprint to legal finish line

March 22, 2016 | Bobby Burch

The Kansas House of Representatives nearly unanimously agreed that the state’s Angel Investor Tax Credits program must continue to boost early-stage businesses.

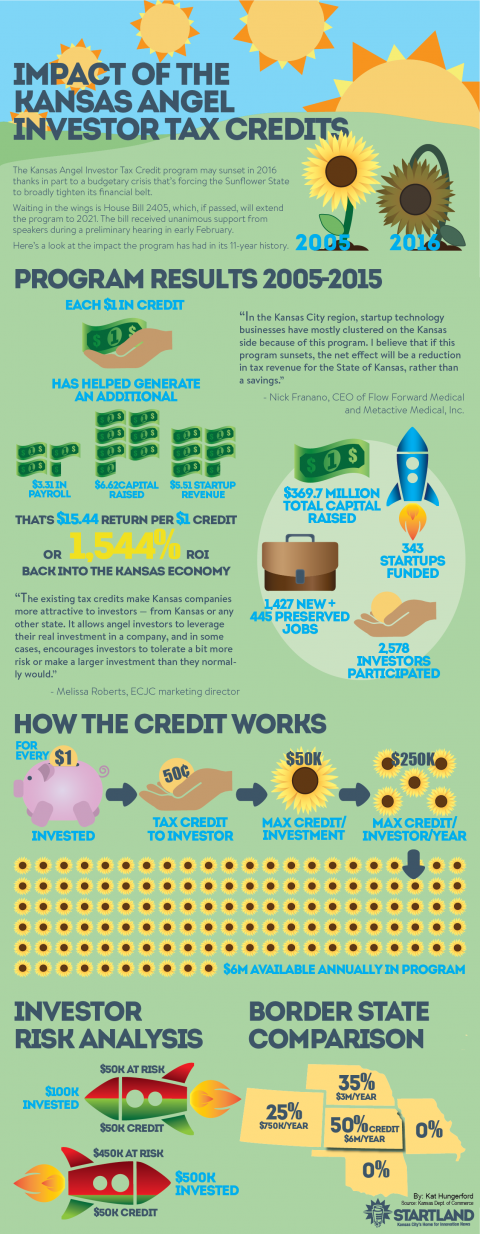

The House voted 122 to 3 in favor of a measure that will extend the life of the $6 million program until 2021. Angel investor tax credits, which are set to expire in 2016, offer accredited investors a tax credit of up to $50,000 on an investment in a Kansas business, helping to mitigate risk and encourage investments.

The bill now goes into conference committee to resolve any disagreements in language. After that, the bill heads to the Kansas Gov. Sam Brownback’s desk for a signature to be made law. The tax credits program is now a part of omnibus tax measure SB 149.

Arguably the biggest win for supporters is that lawmakers retained its current allocation levels of $6 million per year. That allocation is more than double any nearby state offering a similar program. Missouri doesn’t offer angel tax credits, further providing Kansas an advantage in attracting businesses to the state.

The Senate, which already voted on the measure, unanimously supported the bill in a 40 to 0 vote. The three Kansas House members voting against the bill were: Amanda Grosserode, R-Lenexa, Michael Houser, R-Columbus, and Craig McPherson, R-Overland Park.

Kansas’ more than $600 million budgetary shortfall — which resulted from the legislature’s slashing of personal income taxes in 2012 and 2013 — has been the largest complicating factor for the future of the tax credit.

Entrepreneurs and other support organizations have rallied in support of the popular program, which has been tapped by more than 300 startups in its 11 years. In addition to spurring nearly $370 million in total capital raised, the tax credits have helped create more than 1,400 jobs and preserve nearly another 450. Since its inception in 2005, the program has provided $55.9 million in tax credits to investors funding Kansas startups.

Startland News will keep you posted on any updates regarding the bill. For more information on the impact of the program, check the infographic below. To learn more about how it works, check out the bottom of this story.

2016 Startups to Watch

stats here

Related Posts on Startland News

Kansas kicks off effort to increase high-speed Internet for schools

The Sunflower State it planning to boost Internet speeds in its public schools. The State of Kansas on Tuesday announced a partnership with San Francisco-based nonprofit EducationSuperHighway to increase school districts’ access to affordable, high-speed broadband. At no cost, the organization will help districts with IT support and data analysis to help upgrade the schools’…

With a halt on new overtime rules, what’s next for startups?

Disruption is good, right? Well, as the Game of Thrones memes say: “Brace yourselves.” The Department of Labor overtime rules that were originally scheduled to go into effect on Dec. 1 have now been indefinitely postponed due to an injunction issued on Nov.22 by U.S. District Judge Amos Mazzant. These rules were set to nearly…

Program commercializing classroom tech spurs 29 startups, dozens of jobs

A Kansas City program is making strides in its efforts to commercialize local, university-cultivated ideas. In the past four years, KCSourceLink’s Whiteboard2Boardroom program helped create almost 100 jobs and facilitated the creation of 29 new startups, according to a recent progress report. Those companies also generated nearly $16 million in follow-on funding, helping to fuel job…

Local entrepreneurs prompt court to hit pause on Kansas ‘patent troll’ rules

A U.S. District Court of Kansas is collecting more public input on proposed legal rule changes after area entrepreneurs expressed concerns that the measures could make the area a haven for “patent trolls.” Patent trolls are non-practicing entities that purchase broadly defined patents with the intention to sue growing companies that are developing tangentially related…