Settle up with Uncle Sam early (and other tax tips for startups)

January 6, 2016 | Dan Schmidt

Whether it’s your first year of startup life or your twentieth, it’s a great feeling to wrap up the year on December 31 and see just how far you’ve come. January starts off full of promise, and then you remember: You still need to settle up with Uncle Sam.

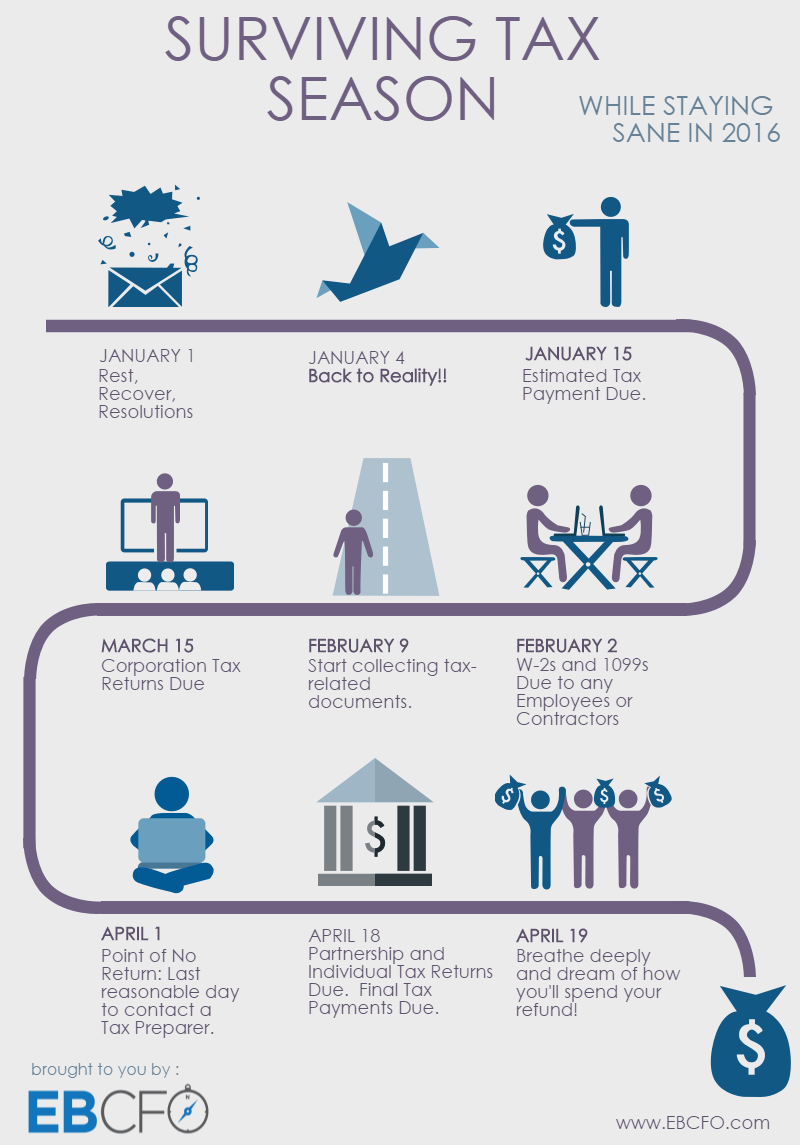

To help put the final ribbon on 2015, here’s your guide to surviving tax season:

First: Make sure you know what income tax return you will be filing

Most companies in the startup world are taxed as either a partnership or a corporation. If you’re an LLC, you could be either. Most of the time you’ll be a partnership, unless it’s just you in the company, then it will probably be reported directly on your personal return. Ask your attorney or CPA if you need clarification.

If you’re a partnership, either with or without investors, the income will flow through to the owner’s personal returns. Each owner will get a Schedule K-1 (Form 1065), but the company itself must still file an informational return, so make sure you file it as soon as you can.

Second: Organize your documents

Organization is everything. Put all mail received in one envelope as it arrives. Even better, digitize everything as soon as you receive it, and consolidate it into a storage drive or Dropbox folder to share with your preparer. Same thing with capitalization (cap) tables, 83b elections and any other significant documents you received during the year.

Make sure your accounting system is up to date – bank reconciliations, loan balances, capital accounts, etc. If you aren’t on one, I recommend Xero.com and can help you get a new client discount if you want to sign up.

To issue 1099s to contractors you’ll need their EIN or SSN. Request a W-9 form from them. Generally, this includes everyone you paid more than $600 who isn’t a corporation, not just people who call themselves contractors. Track1099.com is an excellent tool to automate this process.

As mentioned above, if you’re a partnership, you’ll be issuing a form called a Schedule K-1 to each partner, which shows their portion of the company’s net earnings. You’ll need each partner’s address, tax ID number (SSN or EIN), ownership percentage at both the beginning and end of the year and a few other items. If you don’t have this information readily available, now is the time to get it all pulled together into one location.

Third: Don’t miss deadlines

With so many filings to be done, it’s easy to lose track. Here’s your quick cheat sheet:

- January 15: 4th quarter 2015 estimated tax payment due (sole proprietors and partners)

- February 2: 1099s and W2s

- March 15: corporation returns or extensions due

- April 18: partnership and individual returns or extensions due, final tax payments due

Start the tax process as early as possible. Ideally you’ll have identified your tax preparer and started working with them prior to year end. But if not, plan on getting this finalized in early January.

These deadlines are for federal income taxes only. In addition, there are payroll taxes, sales taxes, state and local taxes, annual registrations, and other possible filings. Be sure to check into your particular requirements in regards to these also.

The Don’t Forgets:

No extensions on payments: Even if you extend your return, tax payments are due on the non-extended deadline. Anything paid afterwards is subject to penalties. Make sure you have enough information to at least make a rough estimate and send it in. Extensions are for filing, NOT for paying.

Ask for discounts: Ask your preparer if they offer discounts for early filing. Many are willing to do this in order to smooth their workflow during tax months. Also, your investors will be very happy if they aren’t waiting on forms from you to finish their personal taxes.

Double-check for possible tax credits: Ask your preparer if you qualify for any specialized tax incentives, such as the R&D credit. They can be a great way to add value to the company down the road and show potential investors that you’re serious about building a company, not just providing a product or service.

Take pity on your preparer: Lastly, your tax preparer is probably working with a couple hundred other companies. Help them help you (yes, I just stole a line from Jerry McGuire) by starting early. If you want strategies on how to make your accountant lose it, read our “helpful” post.

So there you go. One last set of tasks to put 2015 completely behind you and set the stage for winning in 2016.

Dan Schmidt is the founder and CEO of The Emerging Business CFO, a virtual business accounting and financial advisory firm that works to free founders and entrepreneurs from the stress of managing the daily operational grind. The company offers bookkeeping, accounting, cash flow management, payroll and CFO services.

2016 Startups to Watch

stats here

Related Posts on Startland News

Coming UMKC innovation center to serve students, entrepreneurs

With funding shored up from private and public donors, the University of Missouri-Kansas City is planning to move ahead with its plan to build the Robert W. Plaster Free Enterprise Center to support students and entrepreneurs. Missouri Gov. Jay Nixon announced Tuesday that the state is allocating $7.4 million to the center, which represents half…

LaunchKC, Techweek to welcome 10 tech firms to KC in style

In roughly four months, Kansas City will welcome a crop of tech startups bolstered by thousands of dollars in funding and a rockstar arrival. Kansas City’s LaunchKC competition — which aims to attract 10 tech firms to relocate to KC with $50,000 grants — has partnered with national tech conference Techweek to offer the winners…

New platform GUILDit offers art entrepreneurs visibility

A new program called GUILDit to promote and support art entrepreneurship is coming to Kansas City. The program is a bi-monthly gathering where art entrepreneurs take the stage to give six-minute presentations followed by questions and answers in the hopes of crafting a stronger Kansas City art economy, and to further connections between local artists.…