RECAP: 1 Million Cups focuses on time with Mixtape, Flowh

May 27, 2015 | Abby Tillman

There was a theme at today’s 1 Million Cups KC, and it was time.

Two startups presented their businesses, both at different stages, and both in different industries, but both dealing with time — how we remember it and how we manage it.

Mixtape founder Joel Johnson was first to present his firm, which created a card game that prompts players to pair songs with life experiences to cultivate story telling and memory sharing.

“Mixtape gives people a chance and an opportunity to be vulnerable in front of each other, to share something personal about themselves through song,” Johnson said. “These stories are the glue to our relationships, our experiences and our history. …This game helps people tell them.”

Johnson is currently running a Kickstarter campaign, the proceeds of which would allow him to produce cards for the game and get the game into the hands of his customers. He plans to sell the game for $25 at retail locations, though it comes with a discount through the company’s Kickstarter campaign.

After Mixtape, co-founder Eric Darst presented Flowh, a calendar exchange platform. Flowh connects all of the online calendars of interest to a person to one personal calendar with the simple goal of solving the mess of scheduling in a digital world.

“The calendar world is a mess, it’s scattered and inconsistent,” Darst said. “With Flowh you can follow all the calendars that interest you with one click, and sync any events into your own personal scheduler.”

The Flowh team has a growth plan in place, which will follow three phases. First, they plan to expand the use of their “follow” button and secure patents on their product. Next, it will move into the big data industry, and finally, will scale its product internationally.

“We have a desire to be acquired at some point,” Darst said. “So, (our) number of users is very important to us.”

Featured Business

2015 Startups to Watch

stats here

Related Posts on Startland News

DevOpsDays brings two-day grassroots tech conference back to Kansas City

DevOpsDays KC is returning this week with an open spaces concept wherein audience members at the two-day conference vote on the topics to cover in real time, said Ryan McNair. Topics with the most votes create zones in the space in which the audience can flow freely from each area. “If you don’t like it,…

Privacy in practice: Responding to daily cyber threats sharpens Polsinelli tech team

Editor’s note: The following content is sponsored by Polsinelli PC but independently produced by Startland News. We see the fallout nearly every day. Another company, government or celebrity that’s been technologically compromised, prompting officials to scramble on how to best calm customers, citizens and stakeholders. And when you lead one of the nation’s top cybersecurity…

Pint-sized perspective: KC’s Little Hoots takes nostalgia-capturing tech to MIT

From the cute and comedic to the whimsical and wise, every parent can pinpoint a Little Hoots moment that relates to their personal adventure in child-rearing, said Lacey Ellis, founder and CEO of the Kansas City-birthed mobile app that recently turned heads at MIT. “If a picture is worth a thousand words, a hoot is…

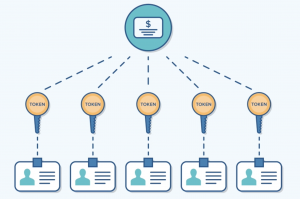

LaunchKC winner bringing cryptocurrency into the investment game with Liquifi

A blockchain-enabled solution from Venture360, called Liquifi, aims to unfreeze startups paralyzed by a lack of access to capital, Rachael Qualls said with excitement. “The main reason more people don’t invest in private companies is there is no way to get money out,” said Qualls, CEO of Venture360. “On average money is tied up for…