Kansas budget woes render uncertainty for angel tax credits

May 2, 2015 | Bobby Burch

As state budgetary concerns loom in the background, early-stage firms in Kansas are hoping a bill to extend the Sunflower State’s Angel Investor Tax Credit program will become a priority for legislators.

Scheduled to sunset after the 2016 fiscal year, the program annually allocates $6 million in credits to entice investments in early-stage, growth-oriented companies in Kansas. HB 2405, which is now awaiting Kansas House approval, would extend the life of the program until 2021.

The bill’s future, however, is in limbo. Kansas faces a projected $600 million budgetary shortfall as a result of the legislature’s slashing of personal income taxes in 2012 and 2013. Legislators now are grappling with the choice to phase out what’s been a popular program, or spend some of the state’s limited dollars.

“It’s difficult right now, considering the budget situation,” said Chris Harris, Angel Investor Tax Credit program director. “But there’s cautious optimism (the bill will pass).”

Harris testifies before Kansas legislators each year, reporting on the program’s success since its 2005 launch. In its ten year life, the program has helped 298 companies raise more than $342.9 million in capital, which has allowed the firms to create 1,188 new jobs. Since 2012, the tax credits have helped create 549 jobs, according to the Kansas Department of Commerce.

The program is off to a hot start in 2015, too. Already more than 50 companies have applied for the credits by March 2015, which Harris said nearly doubles the volume of applications when compared to March 2014.

Melissa Roberts, marketing director for the Enterprise Center of Johnson County, said her organization’s angel investment arm, Mid-America Angels, seeks out the credits with each deal.Roberts said that the tax credits not only entice investors, but also mitigate the risk of backing an early-stage firm.

“The existing tax credits make Kansas companies more attractive to investors — from Kansas or any other state,” she said. “It allows angel investors to leverage their real investment in a company–and in some cases, encourages investors to tolerate a bit more risk or make a larger investment than they normally would.”

Roberts said that more than 20 states have implemented programs to attract or retain investment capital by way of income tax credits. On average, 4.1 new jobs are created for each angel investment made, according to the Center for Venture Research.

Featured Business

2015 Startups to Watch

stats here

Related Posts on Startland News

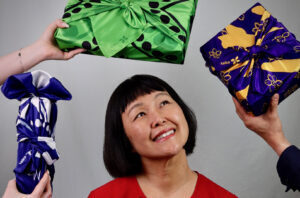

Family’s Japanese-inspired fabric gift wrap hits a home run with new fans (and an iconic American baseball team)

At the intersection of heritage and innovation, a Kansas City family business is pitching a new way to gift, through vibrant fabric package wraps that carry both meaning and intention — even catching the attention of an unexpected collaborator: Major League Baseball. Keiko Furoshiki — a Kansas City brand crafted at the creative fingertips of Japanese-American…

Tech veterans launch startup studio to back next-wave SaaS products with founder-led thinking

Backed by years of entrepreneurial wins, the team behind Full Scale and the exited Stackify just announced a new product studio and startup lab concept — purpose-built for what founder Matt Watson called the post-playbook SaaS era. “Founders today are facing a new set of realities,” said Watson, serial entrepreneur, podcast host, and co-founder of…

Arts summit’s three-year move to KC celebrates flyover country creatives (and the entrepreneurs who make it)

Great art stands on its own merits, said Diane Scott, but if the artist behind a piece can’t or doesn’t sell their vision to the world, their expression hasn’t achieved its goal. “Nobody makes art to not share it with other people,” added Scott, director of artist services for the Kansas-City based Mid-America Arts Alliance,…

How this ‘Hallmark town’ gets its country charm from a Main Street serial entrepreneur

Editor’s note: The following story was produced through a paid partnership with MOSourceLink, which boasts a mission to help entrepreneurs and small businesses across the state of Missouri grow and succeed by providing free, easy access to the help they need — when they need it. WARSAW, Mo. — Owning her own boutique — and…