Kansas budget woes render uncertainty for angel tax credits

May 2, 2015 | Bobby Burch

As state budgetary concerns loom in the background, early-stage firms in Kansas are hoping a bill to extend the Sunflower State’s Angel Investor Tax Credit program will become a priority for legislators.

Scheduled to sunset after the 2016 fiscal year, the program annually allocates $6 million in credits to entice investments in early-stage, growth-oriented companies in Kansas. HB 2405, which is now awaiting Kansas House approval, would extend the life of the program until 2021.

The bill’s future, however, is in limbo. Kansas faces a projected $600 million budgetary shortfall as a result of the legislature’s slashing of personal income taxes in 2012 and 2013. Legislators now are grappling with the choice to phase out what’s been a popular program, or spend some of the state’s limited dollars.

“It’s difficult right now, considering the budget situation,” said Chris Harris, Angel Investor Tax Credit program director. “But there’s cautious optimism (the bill will pass).”

Harris testifies before Kansas legislators each year, reporting on the program’s success since its 2005 launch. In its ten year life, the program has helped 298 companies raise more than $342.9 million in capital, which has allowed the firms to create 1,188 new jobs. Since 2012, the tax credits have helped create 549 jobs, according to the Kansas Department of Commerce.

The program is off to a hot start in 2015, too. Already more than 50 companies have applied for the credits by March 2015, which Harris said nearly doubles the volume of applications when compared to March 2014.

Melissa Roberts, marketing director for the Enterprise Center of Johnson County, said her organization’s angel investment arm, Mid-America Angels, seeks out the credits with each deal.Roberts said that the tax credits not only entice investors, but also mitigate the risk of backing an early-stage firm.

“The existing tax credits make Kansas companies more attractive to investors — from Kansas or any other state,” she said. “It allows angel investors to leverage their real investment in a company–and in some cases, encourages investors to tolerate a bit more risk or make a larger investment than they normally would.”

Roberts said that more than 20 states have implemented programs to attract or retain investment capital by way of income tax credits. On average, 4.1 new jobs are created for each angel investment made, according to the Center for Venture Research.

Featured Business

2015 Startups to Watch

stats here

Related Posts on Startland News

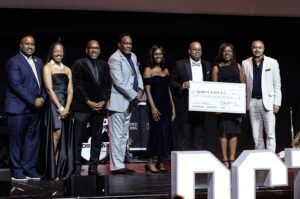

C2FO awards grants to three KC nonprofits boosting Black entrepreneurs with intention

A new grants program developed by one of Kansas City’s biggest scaleups was founded with a clear purpose, said Jay Lott, announcing the effort’s first three nonprofit recipients and touting C2FO’s ongoing commitment to community engagement within the Kansas City region. “We want to support the nonprofit organizations that are focused on intentionally elevating Black…

Grit Road plants $11M venture fund to cultivate homegrown ag tech solutions across Midwest

Startland News’ Startup Road Trip series explores innovative and uncommon ideas finding success in rural America and Midwestern startup hubs outside the Kansas City metro. OMAHA — The precision guide for Grit Road Partners — a Nebraska-based venture fund — is investing in ag tech companies that are solving Midwest producer problems, said Mike Jung,…

KC nonprofit wants to change the face of tech (without leaving its students in debt)

Editor’s note: The following story was sponsored by Resiliency at Work 2.0 Career and Technical Education, a Kansas City-based organization focused on creating and increasing equitable opportunities through education and training for careers in the technically skilled workforce. Dr. Joy Vann-Hamilton set out to close the diversity gap in the tech workforce; her work through…

Proof is in the spending: CEO-to-CEO Challenge yields results in diversifying supply chains

Editor’s note: The following story was sponsored by KC Rising, a regional initiative to help Kansas City grow faster and more intentionally, as part of a campaign to promote its CEO-to-CEO Challenge on supplier diversity. When she started researching the institutional knowledge at MMC Corp. about working with diverse suppliers, national purchasing director Kelli Fraas found the process was…